Cash flow forecasting gives a 360 degree view of your personal finances enabling you to prioritise financial goals to meet your present and future financial commitments, needs and wants.

What is the need to prioritise financial goals?

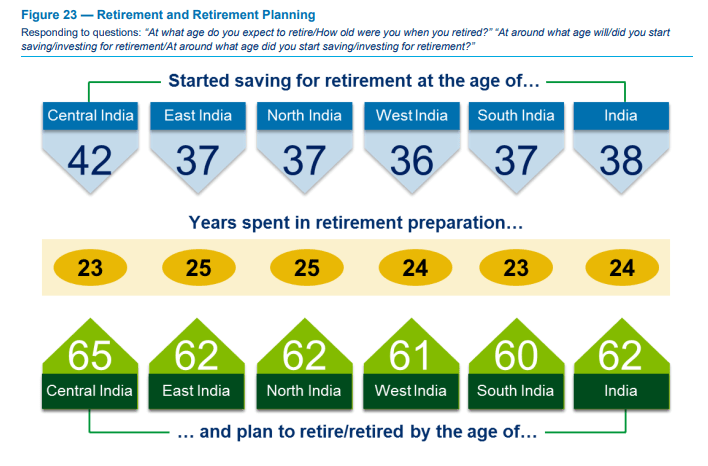

As per a 2018 spotlight on retirement survey done in India by the Society of actuaries and LIMRA, the average respondent started planning financially for their retirement between the ages of 36 to 42 giving them a maximum of 18-24 years to save and invest for their retirement.

Obviously, during this period these respondents were also saving and investing to purchase a home, for their children’s higher education and/or marriage, supporting their parents financially, funding vacations and other goals besides focussing on their career and family.

Prioritising financial goals becomes more and more important as one saves for a broad and diverse set of goals

One tool that aids in prioritising goals is cash-flow modelling and forecasting.

What is cash flow modelling?

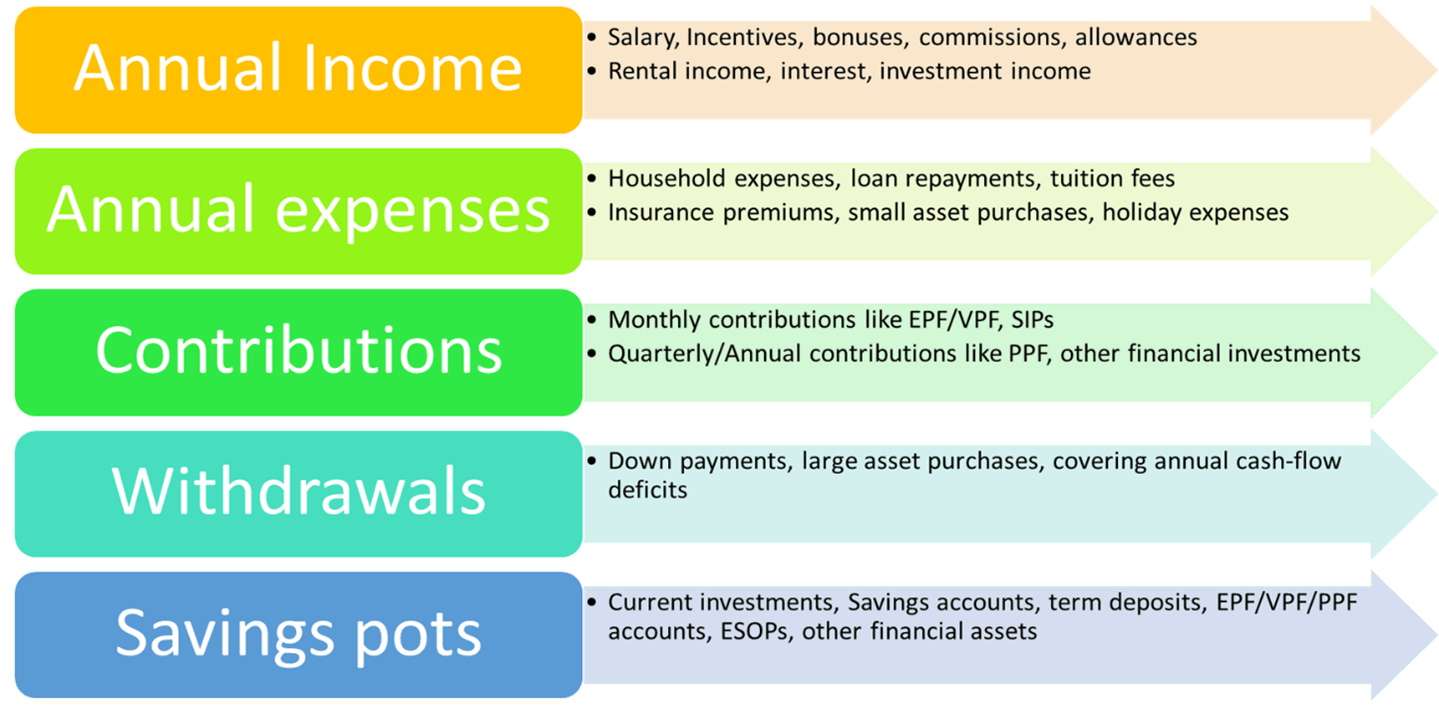

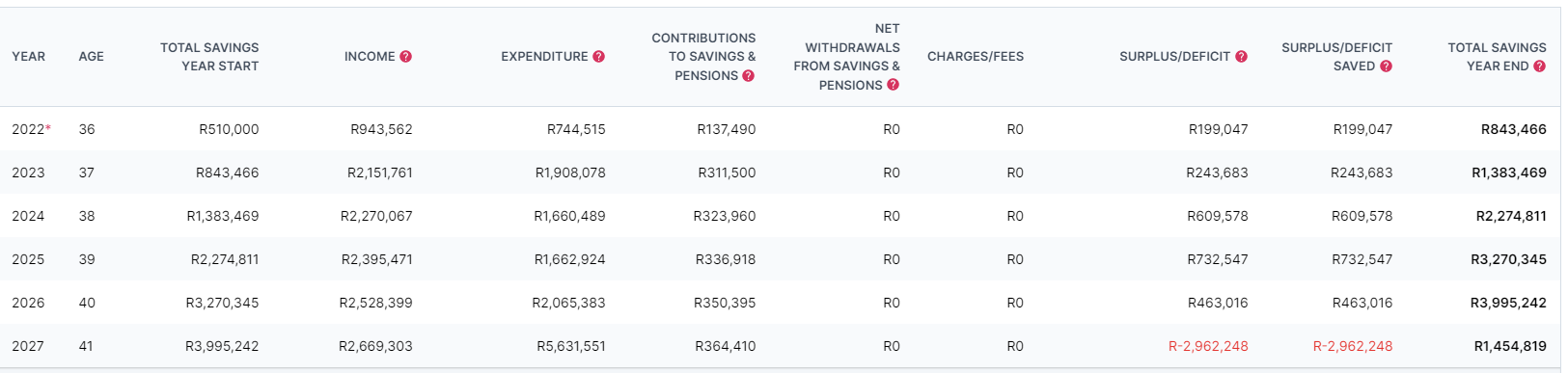

Cash-flow modelling is used to forecast total savings over a specified timeframe. Put simply, the money that you make and earn through income and investments are the input, and all your expenses are the outgo and what remains is either the surplus (positive) or deficit (negative).

The cash flow modelling software forecasts the annual surplus/deficit of an individual/family considering the following elements:

The data used for the elements mentioned above must be as detailed as possible. Clubbing multiple investments in different asset classes together, non-inclusion of certain expenses, income, or investments, holding back financial asset information due to lack of organization, would make use of the cash-flow modeller an irrelevant exercise since the assumptions for each of the categories of these elements would be different.

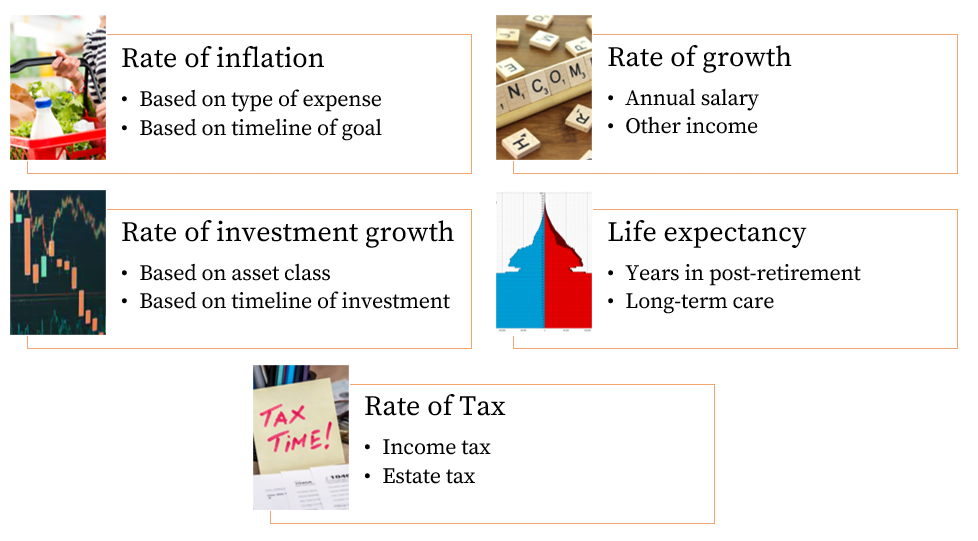

What are the assumptions used in the cash-flow modeller?

The major assumptions used in cash-flow modelling are inflation, investment returns, life expectancy and tax rates

Inflation rates would be assumed and projected based on the type of expense. Household inflation could be assumed to be lower at around 6-7% p.a. On the other hand, the inflation assumption for medical and education expenses, generally higher than CPI, could be 8-10%. Similarly, the corpus amounts for future goals would be inflation adjusted based on their timeline. Another assumption would be annual growth rate of salary and other income.

In case of debt instruments like government schemes and term deposits, depending on the term of investment, the projected return would be less volatile and more linear whereas in the case of equities and gilts more volatility would be assumed while projecting returns.

What does the output from the cash-flow modeller look like?

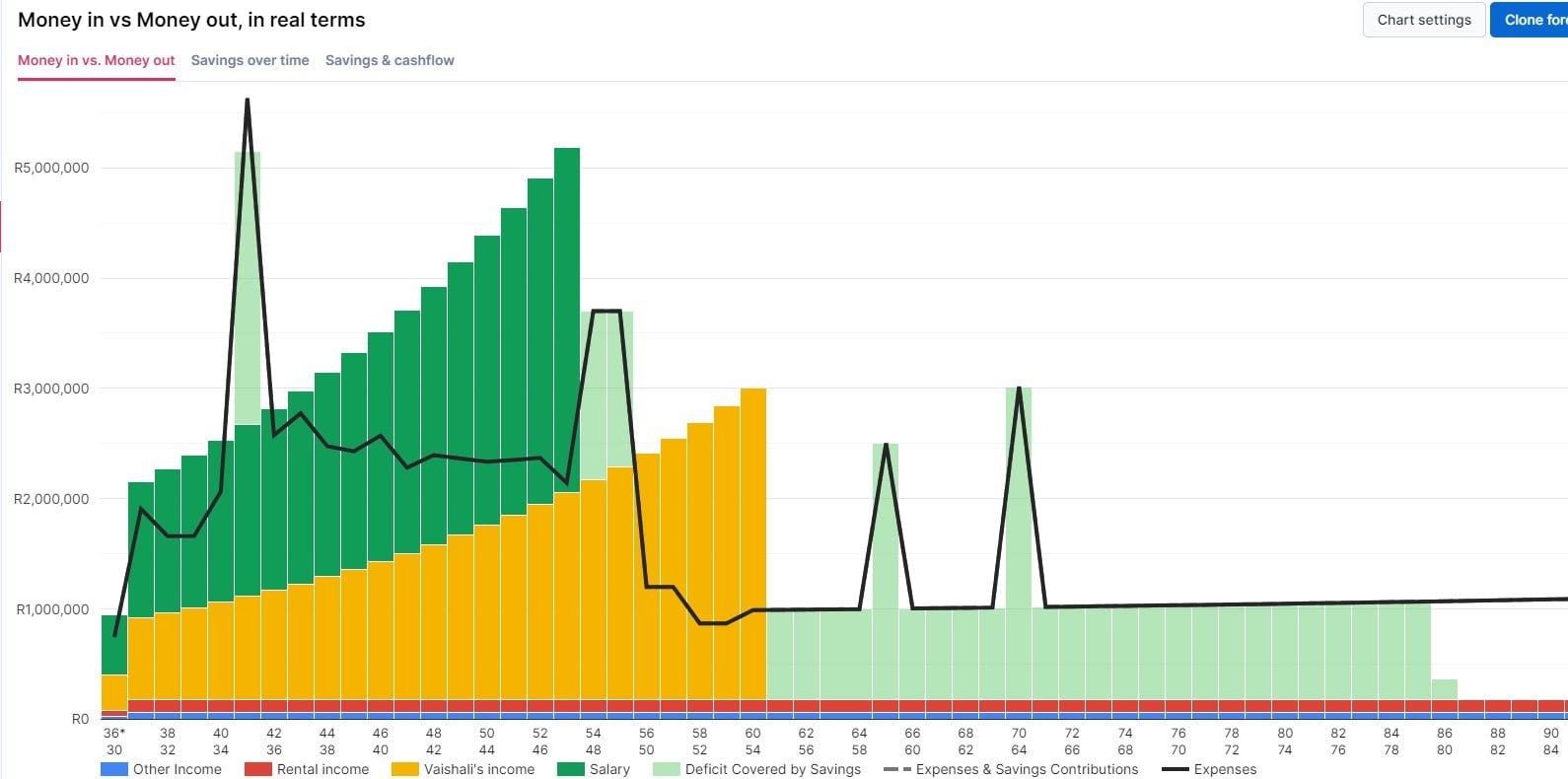

Based on the inputs, the chart below is an example of the lifetime cash-flow forecast using CashCalc’s modelling software.

- The black line is the annual projected expense.

- The large vertical bars (yellow and dark green) are the projected incomes in the pre-retirement phase.

- The light green vertical bar which shows up sporadically before retirement and more consistently post-retirement is the deficit which needs to be covered up through savings to fund goals/expenses.

- The spikes in the annual expense denote major goal-based expenses in that year.

How can the cash-flow modeller be used to prioritise your goals?

Based on the goals and the assumed surplus/deficits, the cash flow modeller will indicate when you are going to run out of money. An example above is the high “expense spike” which can be covered up either through savings or asset sales.

To prioritise financial goals:

- Set aside for emergencies.

- Categorise goals into needs, wants and wishful dreams.

- Allocate available surplus to invest for needs and essential goals first.

- Moderate or delay wants if the surplus is not available or if assumptions used are unrealistic.

- Keep updating and reviewing the data and assumptions at least once every six months.

- Beware of taking high risk to achieve lofty goals.

The cash-flow modeller allows you to look at different scenarios and possibilities while you decide which goal is essential, which one is more of a want, and which one is a dream.

What are the cons of exclusively relying on the cash-flow modeller?

Garbage in and garbage out applies to the use of all software and the cash-flow modeller is no exception. A 200-basis point under-projection of inflation while calculating the corpus for thirty years in post-retirement, could mean running out of money 7 to 8 years early. There are many assumptions used in the cash flow modeller. These assumptions and projections will change over time and turn out to be incorrect many times too.

Inflation, income, expenses, goals, needs, returns, and wants change over time as will your priorities.

If used on a consistent and dynamic basis, the cash-flow modeller allows one to take corrective action to optimize cash-flow. However, it cannot control what happens in the markets or our emotional behaviour and response to changes in those markets.

To summarise, cash-flow modelling software is a useful tool to project surplus and to identify when there would be a deficit and for planning how that deficit would be met whether it is for expenses or for achieving a financial goal. If the assumptions and estimates used are valid and updated continuously, cash-flow forecasting is an important part of personal financial planning.