As an NRI, are you planning to leave your overseas job and come back to India?

What happens to your overseas accounts, savings, NRE FD’s etc? When do you have to start paying tax on your income as a resident Indian?

You are about to make a big decision. When to go back to India? I can’t help you with that decision. However, there are some consequences of returning to India and becoming a Resident from the perspective of FEMA (foreign exchange management act) and Income tax laws.

Who is a Resident?

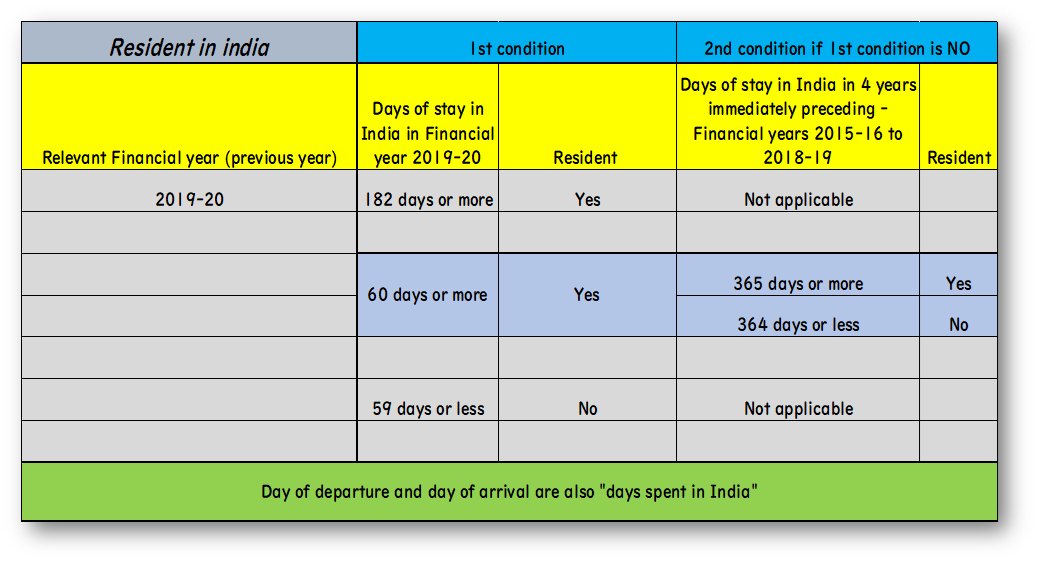

To qualify as a resident Indian, an individual should have spent 182 days or more in India in a financial year OR stayed in India for 60 days or more in a financial year and for 365 days or more in the 4 years preceding that financial year. There’re exceptions to this rule but we’re talking about a future scenario where you are a resident.

E.g. In Financial year 2019-20 you have spent 182 days or more in India OR you have stayed in India for 60 days or more in FY 19-20 and 365 days or more in the 4 years preceding i.e.. 2015-16 to 2018-19.

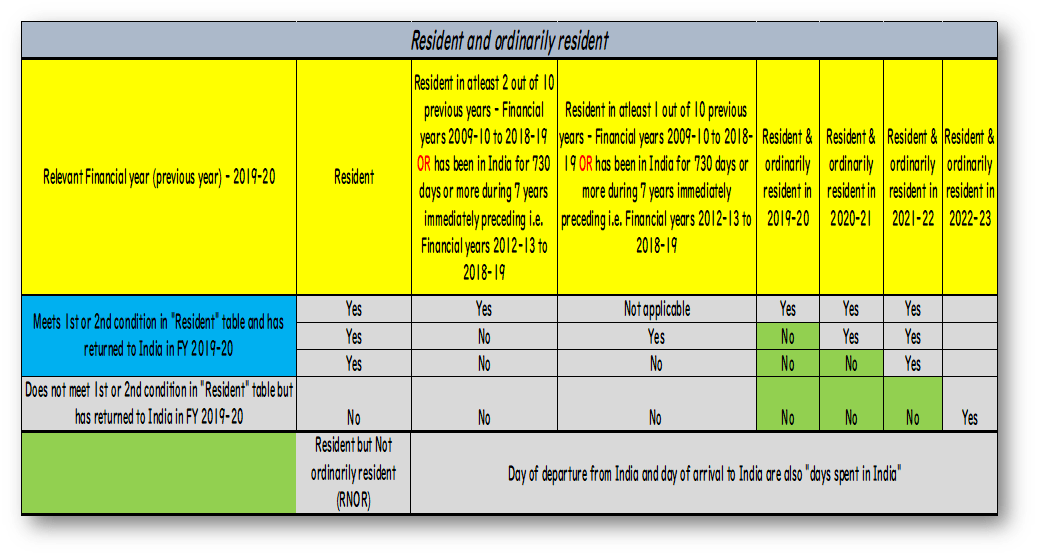

You can either be Resident and ordinarily resident OR resident but not ordinarily resident.

Who is resident but not ordinarily resident?

An individual is “resident and ordinarily resident” if resident in India in at least 2 out of the 10 previous years immediately preceding that financial year OR the individual has been in India for 730 days or more during the 7 years immediately preceding the relevant previous year.

If you don’t meet the above condition you are “Resident but not ordinarily resident” (RNOR).

Effectively, you can enjoy RNOR status for a maximum period of 3 years, depending on the time of your return in any financial year to India.

What are the 7 basic financial to-do’s on your return to India?

- Convert NRE savings accounts to resident savings account immediately.

- Convert any NRE Fixed deposit that you hold to resident fixed deposit immediately. Or transfer the funds in the NRE deposit to your new RFC account. Under FEMA laws, as a resident you are not allowed to hold NRE fixed deposits till their maturity.

- Close your Non-resident demat account. Apply to transfer the holdings to a resident demat account. Update your KYC (know your customer) to reflect that you are a resident Indian.

- As long as you are an RNOR (resident but not ordinarily resident), any overseas income that you receive that has no relation to India i.e. it is not accrued, deemed to accrue, received or deemed to be received in India, is non-taxable. This post will give you more clarification on taxation of overseas income for an RNOR.

- Open a Resident Foreign Currency (RFC) savings account in USD or GBP or other eligible foreign currency. The interest will be non-taxable till you maintain your RNOR status. RBI’s website gives eligibility requirements for an RFC account.

- FCNR(B) deposits – Continue to hold the FCNR(B) deposits till their maturity, on your return to India. The interest on these deposits will not be taxable as long as you are an RNOR. You also have an option of opening FCNR(B) deposits before you return to India.

- Create an emergency fund and get a family floater for your family’s medical insurance needs. Check that your personal finance basics are taken care of.