Six weeks into the COVID-19 lockdown and its associated uncertainties. Personal finance basics couldn’t be any more important. Spending on essentials only. Zero spending on lifestyle expenses for 40 days. Unthinkable, but as the lockdown has shown eminently doable and survivable.

What would happen to your finances in these circumstances?

- An accident/major illness in the family.

- A long sabbatical.

- Sudden Job loss.

- Becoming self-employed/freelancing.

A common thread in these situations is how prepared are you for a sudden loss of regular income or an unexpected major expense. Would it mean taking that personal loan that your bank or credit card issuer dangles in front of you?

A more serious situation could be the loss of a loved one who was the sole/major earning member in the family.

What are the 6 essential personal finance basics?

- Emergency funds

- Health Insurance

- Term Insurance

- Credit Score

- Secure Investment/bank accounts

- Nominations/Will

- Emergency funds: Monthly household expenses equivalent to a minimum of 6 months, ideally 9-12 months, should be your set-aside emergency funds. In addition, annual expenses equivalent to that period, loan EMI’s and other miscellaneous expenses also make up a part of your emergency funds. These funds can help you tide over a temporary loss of income, a job transition or a family emergency. If you’re planning a long sabbatical or are thinking of becoming self-employed then you will need an equivalent of 12-18 months expenses as an emergency fund.

Save the emergency funds in a fixed deposit/Overnight Liquid fund. Do not chase returns. Safety/liquidity should be the priority.

- Health Insurance: You probably have an employee group health plan covering you for medical expenses. However, that plan will not cover you when you’re in transition between jobs.

Get a family floater plan to cover your family’s health. You can start with a ₹10L sum assured for a tier1/2 city and ₹5L for a tier 3 city. Buy an additional super top-up policy for ₹20L-₹50L from the same health insurer as your base policy. This policy has a vastly lower premium than the base policy and can cover your family against major accidents/illnesses.

You’ll still require an emergency fund in case a non-network hospital performs the procedure or if you’re forced to go for reimbursement instead of the cashless option.

You can check out my post on buying a health insurance policy.

- Term insurance: A pure term plan is a low-cost way to transfer the risk of protecting your family from loss of income due to your death, to an insurer. Pure term plans do not give any return if you outlive the policy. The best term plan is the one you don’t use. It has protected your family and you don’t need it anymore since you’re now retired/ have achieved major life goals/built a satisfactory corpus.

There’re two major ways to calculate how much term plan is adequate.

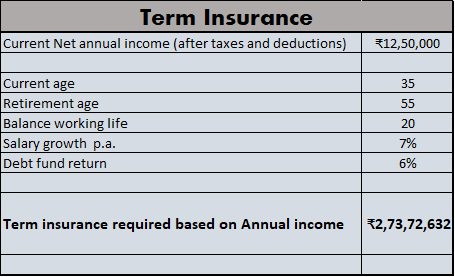

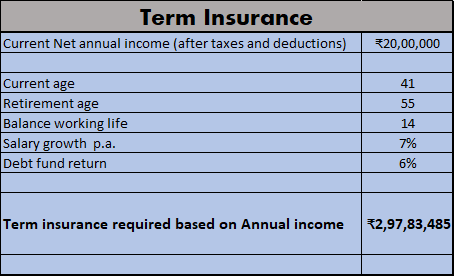

Income: Calculate the current value of future net income (after taxes & deductions) for balance of your working life considering expected income growth.

Term Insurance Calculation- Income method

Term Insurance Calculation- Income method

Term insurance calculation – Income method

Term insurance calculation – Income method

In both these instances, the term insurance required is based on current net annual income and balance working life of the individual. These figures might change depending on future income growth or choosing a higher or lower age for retirement.

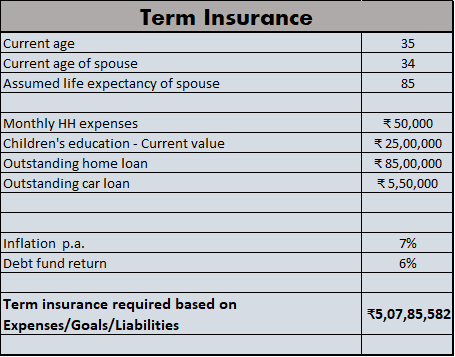

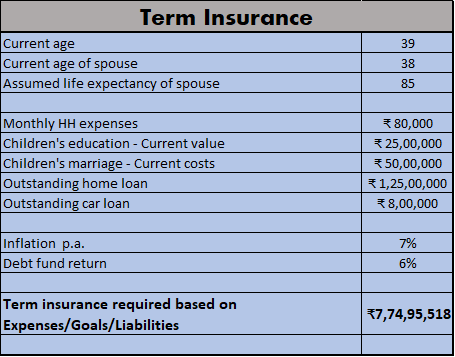

Expenses: In this method, your term insurance will depend on current value of:

a) Monthly expenses for the rest of your spouse’s expected life.

b) All outstanding loans.

c) All future financial goals.

Term insurance calculation – Expenses method

Term insurance calculation – Expenses method  Term insurance calculation – Expenses method

Term insurance calculation – Expenses method

As you achieve some of these goals and pay back major liabilities, the term insurance required will reduce.

Distribute the term insurance requirement among 2-3 policies so that you can review and keep as per your changing needs.

- Credit Score

Do you repay your credit card debt every month or roll it over? If you roll it over, you end up paying an interest as high as 36-42% p.a., not to mention the late payment penalties. You also are taking money, that your future goals require, to pay the credit card issuer now.

Your payment history and credit utilization have a large impact on your Credit Score. Get your free Credit report annually and check for inconsistencies or mistakes in regard to your loan or credit card account. Get in touch with the lender/credit card issuer to correct any mistakes.

- Secure Investment accounts

Is your spouse aware of your family’s banking/investment/demat/credit card accounts/insurance policies? Do you have a nominee for your investment accounts and policies? An accident/illness will not come with prior notice.

Do you have similar passwords for accessing these accounts? Use a password manager like Dashlane or 1Password to share relevant passwords with your spouse. Use Diceware to create one robust master password which you need to remember. Create a common secure folder for soft copies of important financial data.

All your financial accounts might have a nominee/joint holder.

However, on your death, unless you have a will in place, the nominee/joint holder can only hold the funds/property etc on behalf of the final heirs.

- Will

Nomination does not mean inheritance. Make a will detailing all the assets that you own and mention who is it that you want to inherit them. Making a will does not mean that you’re going to die soon. However, lack of a will means dying intestate i.e. the relevant succession act under the law will decide who among your heirs will inherit and in what proportion.

Check out this article which enumerates the requirements of a will.

You can also use an online service like Willjini to create your will.

To recap, the 6 essential personal finance basics can protect you in a financial emergency, protect you and your family’s health as well as ensure that your assets are transferred to your rightful heirs.