Introduction

Welcome to our comprehensive FAQ guide on money management for beginners! 🎉💡 In this guide, we’ll explore key topics like mutual fund diversification, starting your investment journey, managing expenses and savings, and making informed financial decisions.

We’ll answer questions like “How to become financially literate?” and “How to successfully manage your finances?” and many more. So, let’s dive in and start our journey towards financial literacy! 🚀💵

Section 1. Money Management – Expenses & Savings

1.1 Tracking Monthly Expenses

Question: How do you track monthly expenses?

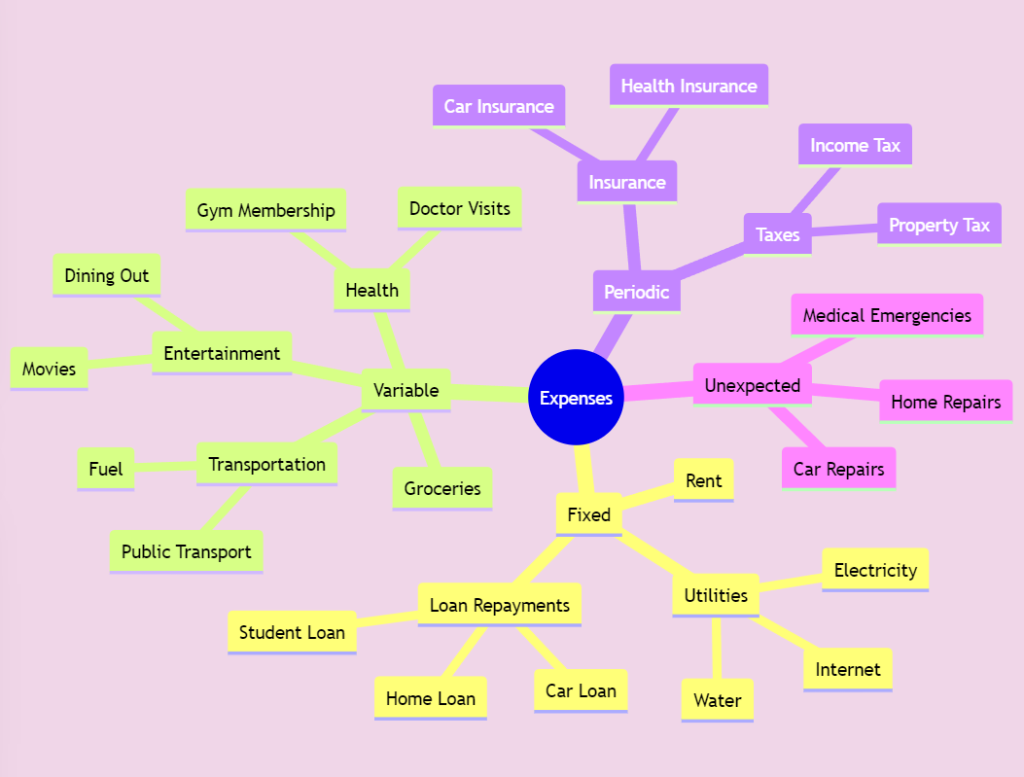

- Start by listing all your expenses. This includes fixed expenses like rent and utilities, and variable expenses like groceries and entertainment. Also list down the periodic and unexpected expenses that you incur. It’s like listing all the meals and snacks you eat in a day. 📝💸

- Use a budgeting app like Mint, YNAB, Pocketguard etc. to track your expenses and to stay on course with your budget. 📱💰

- Review your expenses regularly. This can help you identify areas where you can cut back and save money. The key is to get a balance between spending on your needs while also taking care of some of the wants.👀🍔

1.2 Managing Emergency Funds

Question: I’m not sure what how to manage money…my emergency funds always get spent on family emergencies. How can I manage my money?

- Managing money is like managing your time. You need to prioritize, plan, and stick to your plan. 💼⏰

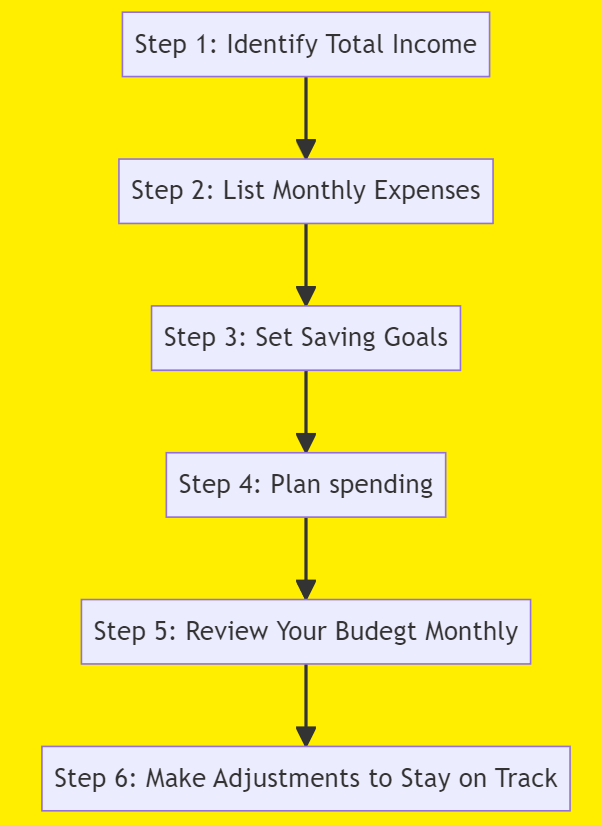

- Start by creating a budget. It’s like making a schedule for your day. Allocate money for different expenses like you allocate time for different activities. 📝💰

- Build an emergency fund. It’s like setting aside time for unexpected tasks. This fund should cover, at a minimum, 3–6 months of living expenses and should only be used for real emergencies. 🚨💵

- If your emergency fund is getting spent on family emergencies, it might be time to have a conversation with your family about financial planning. It’s like discussing time management with your team at work. Everyone needs to understand the importance of planning and sticking to the plan. 🗣️👨👩👧👦

1.3 Money management with Multiple Responsibilities

Question: I am 24F, My salary is 1L pm, My house rent is 21K, I have student loan EMI 13k pm, apart from that 3k for cook and cleaner. I want to send some fraction of my salary to my parents as well (advice me how much should I send). Please advise me what should I do with the rest of the money?

- Managing your finances with multiple responsibilities is like cooking a multi-course meal. It requires careful planning and execution. 🍽️💵

- Start by creating a budget. This is like planning your menu. It helps you manage your money effectively and allocate funds for each responsibility. 📝🍲

- The amount you send to your parents depends on their needs and your financial situation.You can either send them an allowance every month or invest it as a lumpsum in an appropriate debt scheme that can generate passive income. 🧓👵

- After covering your expenses and supporting your parents, consider saving and investing the rest. It ensures you have money for emergencies and future goals. 💾🔄

1.4 Managing Finances with High Salary

Question: I get 2L in hand as salary/month. Invest 50k in SIP. My expenses per month don’t cross 30k as I live in tier 2 city. I have about 20 lakhs lying in my saving account. I have an investment of 25 lakhs with an investment firm I made back in 2014. What should I change to be more financially smart?

- Being financially smart is like being a good chef. You need to know how to use your ingredients (money) effectively to create a great dish (financial future). 🍲💰

- Review your financial goals. This is like checking your recipe. Are your current investments helping you reach your goals? If not, you might need to adjust your investment strategy. 📝🎯

- Consider diversifying your investments. This is like using a variety of ingredients in your dish. You might need a mix of equity (for growth), debt (for stability), and hybrid funds (a mix of both). 🥕🥦🍅

- Make your money work for you. Money lying in a savings account is losing its purchasing power due to inflation risk. Consider investing it in a way that aligns with your financial goals and risk tolerance. This is like using all your ingredients instead of letting them go to waste. 💸🔄

1.5 Budgeting

Question: I am not sure how to allocate and set up my finances, and set my budget targets.

- Setting up your finances and budget targets is like planning a road trip. You need to know your destination (financial goals), your route (financial plan), and your stops along the way (budget targets). 🚗🗺️

- Start by setting financial goals. These are your destinations. It could be buying a car, buying a house, or retiring early. 🎯🏠

- Make a financial plan. This is your route. It should include how much you need to save and invest to reach your goals. 💼💰

- Set budget targets. These are your stops along the way. They help you stay on track and ensure you’re making progress towards your goals. 📍🔄

- And remember, just like you might use a GPS or a travel guide on a road trip, consider using a budgeting app to help you set up your finances and budget targets. 🧭📲

Question: I am 26M, My salary is 1L pm, My house rent is 21K, I have student loan EMI 13k pm, apart from that 3k for cook and cleaner. I want to send some fraction of my salary to my parents as well (advice me how much should I send). Please advice me what should I do with the rest.

- Managing your finances with multiple responsibilities is like cooking a multi-course meal. It requires careful planning and execution. 🍽️💵

- Start by creating a budget. This is like planning your menu. It helps you manage your money effectively and allocate funds for each responsibility. 📝🍲

- The amount you send to your parents depends on their needs and your financial situation. It’s like deciding how much food to prepare based on the number of guests and the ingredients you have. 🧓👵

- After covering your expenses and supporting your parents, consider saving and investing the rest. This is like storing leftovers for later and using your cooking skills to start a food business. It ensures you have money for emergencies and future goals. 💾🔄

- And remember, just like you might take a cooking class or use a recipe app to improve your cooking skills, consider taking a personal finance course or using a budgeting app to improve your money management skills. 🧑🍳📚

Section 2. Taking the important Financial Decisions

2.1 Deciding on a Car Purchase

Question: I am planning to Purchase a Car. I have sufficient money to purchase it but my concern is regarding whether to buy it by paying all at once or to take a loan for it.

- Buying a car is a big decision, like planning a big vacation. You need to consider your budget, your needs, and your future plans. 🚗🌍

- If you have enough money to buy the car outright and it won’t affect your other financial goals, it might be a good option. It’s like paying for your vacation upfront to avoid interest charges on your credit card. 💵🏖️

- But if paying for the car outright will deplete your savings or affect your other financial goals, taking a loan might be a better option. It’s like choosing a vacation payment plan that allows you to spread the cost over time. 📆💳

- Remember, just like you would compare vacation packages before choosing one, compare car loans before choosing one. Look at the interest rate, the loan term, and the total cost of the loan. 🧐🔍

2.2 Deciding on Loan Against Mutual Fund Investment

Question: What are loans against mutual fund investments?

- A loan against mutual fund investment is like taking a loan against your house. You’re borrowing money against an asset you own. These are also called loan against securities and can be raised against eligible mutual funds and shares that you own. 🏠💵

- Just like you need to understand the terms and conditions before taking a loan against your house, you need to understand the terms and conditions of a loan against mutual fund investment. This includes the interest rate, repayment terms, and what happens if you can’t repay the loan. 📄🔍

- Remember, just like taking a loan against your house can put your house at risk, taking a loan against your mutual fund investment can put your investment at risk. So, consider your options carefully. 🤔⚖️

2.3 Deciding on SIPs and Investments

Question: I’ve been working since the last 1-year now but am not able to understand how to decide my SIP / investments and tax saving plans.

- Deciding on your SIP, investments, and tax saving plans is like planning a balanced diet. You need to consider your health goals (financial goals), nutritional needs (investment needs), and dietary restrictions (tax considerations). 🥗💰

- Start by setting financial goals. These are your health goals. It could be buying a car, buying a house, or retiring early. 🎯🚗

- Decide on your SIP and investments based on your financial goals and risk tolerance. This is like planning meals based on your health goals and dietary preferences. You might need a mix of equity (for growth), debt (for stability), and hybrid funds (a mix of both). 🍽️📈

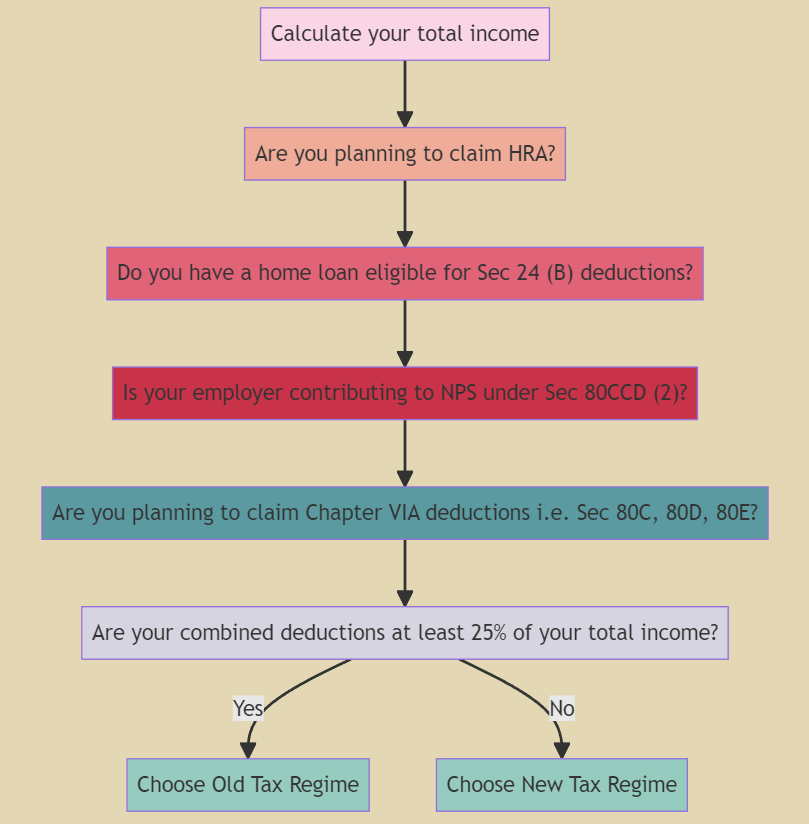

- Consider tax saving plans as part of your overall financial plan. There are several tax-saving investment options available, like PPF, NPS, and EPF.🧾💵

2.4 Deciding on Equity-Debt Ratio

Question: Why do people still want to maintain equity-debt asset allocation ratio if the debt part is illiquid?

- Maintaining an equity-debt ratio in your portfolio is like maintaining a balanced diet. Even if some foods are harder to digest (illiquid), they still provide essential nutrients (benefits). 🥗💵

- Equity investments, like stocks, are like carbohydrates. They provide energy (returns) quickly but can also lead to crashes (losses). 🍞📈

- Debt investments, like bonds, are like proteins. They provide energy (returns) more slowly and steadily, but they’re harder to digest (illiquid). 🥩📊

- A balanced portfolio, like a balanced diet, includes a mix of both. The right balance depends on your financial goals, risk tolerance, and investment timeline, just like the right diet depends on your health goals, body type, and lifestyle. 🎯⚖️

2.5 Deciding on Financially helping Parents

Question: When is it okay to say no to constantly helping parents out financially?

- There are no easy answers to this question. Helping parents financially is a sensitive topic, much like deciding who does which chores in a shared house. It’s important to have open and honest conversations about it. 🏠🗣️

- If helping your parents is affecting your ability to meet your own financial goals or obligations, it might be time to have a conversation about it. It’s like discussing chore distribution when one person’s workload is affecting their ability to do their own tasks. 🎯🔄

- It’s okay to say no if you’re unable to help without jeopardizing your own financial stability. But remember, it’s important to communicate this in a respectful and understanding way. 🚫💬

- Consider discussing alternative solutions, like helping your parents create a budget or find ways to reduce expenses. It’s like suggesting a chore schedule or efficiency improvements in a shared house. 📝💡

2.6 Can I afford a House?

Question: Can I afford a house with 18 LPA + salary?

- Think of buying a house like planning a big trip. You wouldn’t spend all your savings on one trip, right? Similarly, when buying a house, your monthly EMI should not be more than 30-40% of your take-home pay. 🏠💰

- Just like you use online tools to plan your trip, you can use online EMI calculators to estimate your home loan EMI. This will give you a clear idea of whether you can afford the house or not. 🧮👩💻

- But remember, buying a house involves other costs too. Don’t forget to consider one-time costs like stamp duty charges and home furnishing costs. Then there are other regular expenses to be budgeted like maintenance, property taxes, and insurance when buying a house. 🏘️💼

Section 3. Starting Your Investment Journey

3.1 Beginning Your Financial Literacy Journey

Question: How to become financially literate?

- Becoming financially literate is like learning a new language. It might seem difficult at first, but with regular practice and the right resources, you can become fluent. 💬💡

- Start with the basics. Just like you would learn the alphabet and basic grammar of a new language, start with understanding basic financial concepts like savings, budgeting, investing, and compounding. 📚🔠

- Use reliable resources. There are plenty of books, online courses, and blogs that can help you understand financial concepts. It’s like using a language learning app or taking a language course. 📖📱

- Practice makes perfect. Apply what you learn by creating a budget, starting a small investment, or tracking your expenses. 🔄🎯

Question: Hello all, I’m earning 15.5L and recently married. After deductions, I have ₹95k in hand. After rent and other expenses, I am left with 20-30k in hand. Interested in investments and gaining new knowledge. But I don’t want to trust YouTube’s so called “Financial advisors”. So seeking out some help to start my investment journey.

- Starting your investment journey is like starting a new workout routine. You need to understand your fitness level (financial situation), set fitness goals (financial goals), and choose exercises (investments) that help you reach your goals. 🏋️♀️💪

- Understand your financial situation. This is like assessing your fitness level. You’ve already done this by calculating your income and expenses. 👏💼

- Set financial goals. These are your fitness goals. It could be buying a car, buying a house, or retiring early. 🎯🚗

- Choose investments that help you reach your goals. This is like choosing exercises that help you reach your fitness goals. You might need a mix of equity (for growth), debt (for stability), and hybrid funds (a mix of both). 🏃♀️💰

3.2 Starting Your Investment Journey

Question: Need guidance to start my investing journey, emergency fund and more.

- Starting your investing journey is like starting a fitness journey. You need to set goals, make a plan, and stick to it. 🏋️♀️💪

- Your SIP is like your workout routine. Just like you would choose exercises that help you reach your fitness goals, choose investments that help you reach your financial goals. 🏃♀️💰

- Your emergency fund is like a first aid kit. It’s there to help you in case of emergencies. Aim to have 3-6 months of living expenses, EMIs and insurance premiums in your emergency fund. 🚑💵

3.3 Investing in Your Early 20s

Question: I’m 22 years old and have just joined a company that pays me well enough for my survival as a fresher, but I have little to no knowledge of investing.

- Starting your investing journey at a young age is like learning a new language early. It might seem challenging at first, but the earlier you start, the more time you have to practice and become fluent. 🌱💬

- Start by setting financial goals. It’s like deciding why you want to learn a new language. Maybe you want to travel, or maybe you want to work in a foreign country. Similarly, your financial goals could be buying a car, buying a house, or retiring early. 🎯🚗

- Learn the basics of investing. There are plenty of resources online, like blogs, podcasts, and online courses, that can help you understand the basics. It’s like using a language learning app or taking a language course. 📚📱

- Start small. You don’t have to invest a lot of money to start. You can start with a small amount and gradually increase it as you become more comfortable with investing. It’s like starting with basic phrases in a new language and gradually learning more complex sentences. 🐣🔝

3.4 Investing in Your Mid 20s

Question: I’m 23M with a monthly salary of 1L and an additional 20-30k from side gigs. After deducting expenses like electricity, internet, EMI, and supporting my parents, I’ll have around 80k remaining. How to save money, and what should I do with the remaining money?

- Managing your money at a young age is like learning to cook. It’s a valuable skill that will benefit you for the rest of your life. 🍳💰

- Start by creating a budget. This is like planning your meals. It helps you manage your money effectively and avoid unnecessary expenses. 📝🍽️

- Save a portion of your income. This is like storing leftovers for later. It ensures you have money for emergencies and future goals. 💾🍲

- Invest the remaining money by allocating to debt and equity based on your risk preference. This is like using your cooking skills to start a food business. It helps your money grow over time. 🔄📈

- And remember, just like you might take a cooking class or use a recipe app to improve your cooking skills, consider taking a personal finance course or using a budgeting app to improve your money management skills. 🧑🍳📚

3.5 Investing in Stock Market

Question: I am a noob and trying to get into the stock market. Need suggestions please.

- Entering the stock market for the first time is like learning to swim. It might seem intimidating at first, but with the right guidance and practice, you can become proficient. 🏊♂️💹

- Start by learning the basics. Understand what stocks are, how the stock market works, and the risks involved. It’s like learning about water safety and basic swimming techniques before jumping into the pool. 📚🌊

- Start small. When you’re ready to invest real money, start with a small amount that you can afford to lose. It’s like starting to swim in the shallow end before moving to the deep end. 💰🏊♂️

Section 4 Understanding Investments

4.1 Diversification in Mutual Funds

Question: What is Mutual fund diversification vs over diversification?

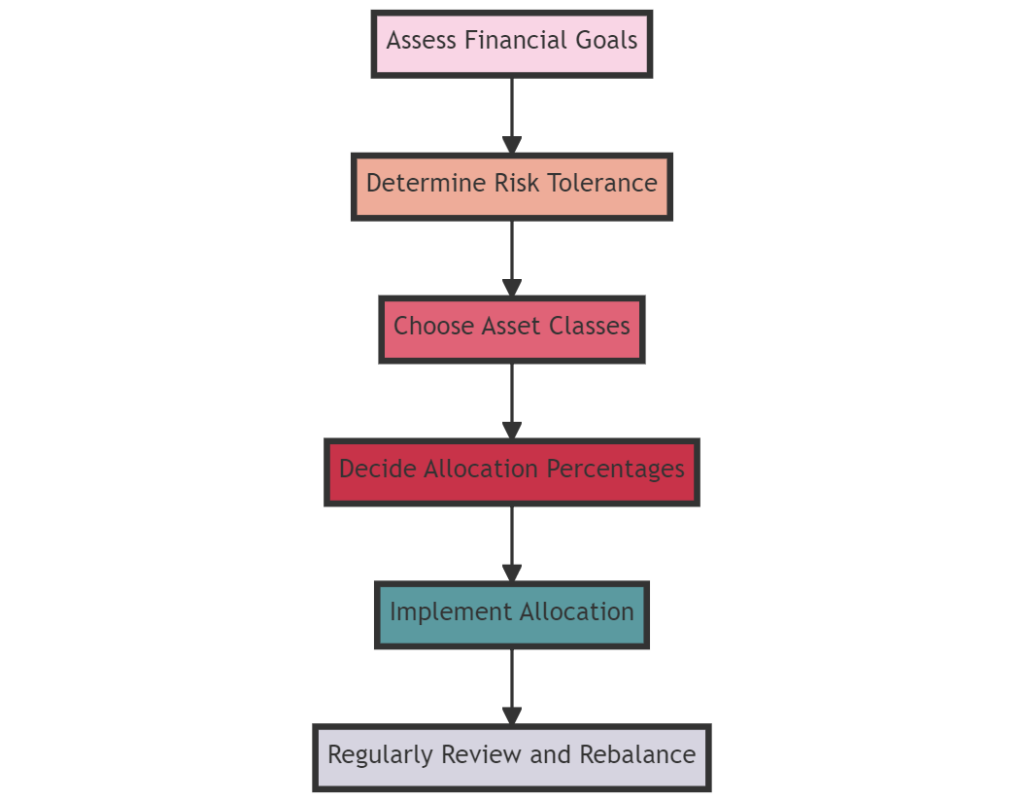

- Diversification in mutual funds is like creating a balanced diet from different food groups. Just as you need proteins, carbs, and fats for a healthy body, your portfolio needs a mix of equity (for growth), debt (for stability), and hybrid funds (a mix of both) for a healthy financial future. This is known as asset allocation. 🥗💰

- Asset allocation is a strategy that balances risk and reward by adjusting the percentage of each asset in your portfolio according to your risk tolerance, goals, and investment timeline. It’s like adjusting your diet based on your health goals, age, and lifestyle. 🎯🔄

- Overdiversification, on the other hand, is like adding too many ingredients to your dish. It can dilute the flavor (returns) and make it difficult to manage. A well-diversified portfolio typically has 2-3 different funds, just like a well-balanced meal has a few key ingredients. 🍲📊

- The key is to find the right balance. Too little diversification (concentration) can expose you to unnecessary risk (like eating only one type of food can lead to nutritional deficiencies), while too much diversification can make your portfolio unwieldy and dilute your returns (like adding too many ingredients can ruin a dish). ⚖️👌

4.2 Portfolio Allocation

Question: The idea is to keep mutual funds for a long term (5Y or more) so that it could provide me with decent returns. What do you suggest is this allocation right in terms of MFs and the money allocation?

- Investing in mutual funds for the long term is like planting a tree. It takes time to grow, but the results can be worth the wait. 🌳💰

- The right asset allocation depends on your financial goals, risk tolerance, and investment horizon. It’s like choosing the right spot to plant your tree, considering the sunlight, soil type, and space it needs to grow. 🌞🌱

- However,equity should be used for goals with a timeline of at least 10 years. For short-term goals use debt investments instead.🧑🌾📲

4.3 Choosing the Right NPS Fund

Question: Please share your views if you have an ongoing NPS pension fund contributions. Please advise as to how to choose the right NPS fund and the ECGA allocation?

- Choosing an NPS fund is like choosing a school for your child. You would consider factors like the school’s reputation, the quality of education, and the fees, right? Similarly, when choosing an NPS fund, consider the fund’s performance, the fund portfolio, and the fees charged by the fund. 🏫💼

- The right ECGA allocation depends on your retirement goals, risk tolerance, and investment horizon. It’s like choosing the right curriculum for your child based on their interests, abilities, and future plans. 📚🎓

- One important point to be kept in mind is that NPS tier-1 invetsments are locked in till age 60 when only 60% of the fund value can be withdrawn and the rest has to be used to buy an annuity. 🧑🎓📲

4.4 Understanding Direct Equities

Question: Do direct equities provide better returns than mutual funds?

- Comparing direct equities and mutual funds is like comparing cooking at home to eating at a restaurant. Both can provide good results, but they require different levels of knowledge and effort. 🍳🍽️

- Direct equities can provide higher returns, but they also come with higher risk. You have more control over the ingredients and the final result, but it requires more knowledge and effort. 🏠🍲

- Mutual funds provide diversification and are managed by professionals. It’s like eating at a restaurant. You get a variety of dishes prepared by a professional chef, but you pay a fee for the service. 🏨🍛

- The choice between direct equities and mutual funds depends on your financial goals, risk tolerance, and investment knowledge. 🎯

- Allocating your assets based on your goals and risk tolerance to appropriate asset classes like equity and debt will reduce risk in your portfolio while also diversifying your portfolio. This is more important than choosing individual products.🧑🍳📚

4.5 Equity Schemes

Question: How many equity MF schemes (which scheme) should one have in their portfolio?

- Choosing equity mutual fund schemes for your portfolio is like choosing dishes for a dinner party. You want a variety that caters to different tastes, but not so much that it overwhelms your guests or becomes hard to prepare. 🍽️🎉

- Passive index funds provide the advantages of diversification as well as low expense ratios. 📈🎯

- As a general rule, having around 2-3 equity schemes in your portfolio can provide sufficient diversification. 🥇💡

4.6 Retirement Planning

Question: I am in my mid 20s and I was looking for a suitable instrument for creating a corpus for my retirement.

- Planning for retirement in your mid-20s is like planting a tree. The earlier you start, the more time it has to grow. 🌳💰

- Start by setting a retirement goal. This is like deciding what type of tree you want to grow. Consider how much money you’ll need for a comfortable retirement. 🎯🌴

- Allocate your monthly investments to appropriate assets like EPF/VPF/NPS as part of your debt portfolio and index funds as part of your equity portfolio while funding your retirement. 🌱📈

- Regularly invest in your retirement fund. This is like regularly watering your tree. Consider setting up a SIP (Systematic Investment Plan) to automate your investments. 💧🔄

Conclusion: And that’s a wrap on our FAQ guide on money management for beginners! 🎉💼 We’ve covered a lot of ground, from understanding investments and starting your investment journey, to managing expenses and making financial decisions. Remember, the journey to financial literacy is a marathon, not a sprint. Take your time, keep learning, and don’t be afraid to ask questions. Here’s to your financial success! 🥂💰