NRI Compliance made easy: 7 tips

Becoming a Non-Resident Indian (NRI) brings a new set of financial responsibilities and compliance requirements. The Reserve Bank of India (RBI) has laid down specific guidelines for NRIs to ensure…

Becoming a Non-Resident Indian (NRI) brings a new set of financial responsibilities and compliance requirements. The Reserve Bank of India (RBI) has laid down specific guidelines for NRIs to ensure…

Are you struggling with credit card debt and looking for ways to effectively manage it? You’re not alone. Many people find themselves overwhelmed by steep interest rates, penal charges and mounting debt. But don’t…

Health insurance is an essential investment to protect you and your loved ones from unexpected medical expenses. However, with so many health insurance policies available in India, it can be…

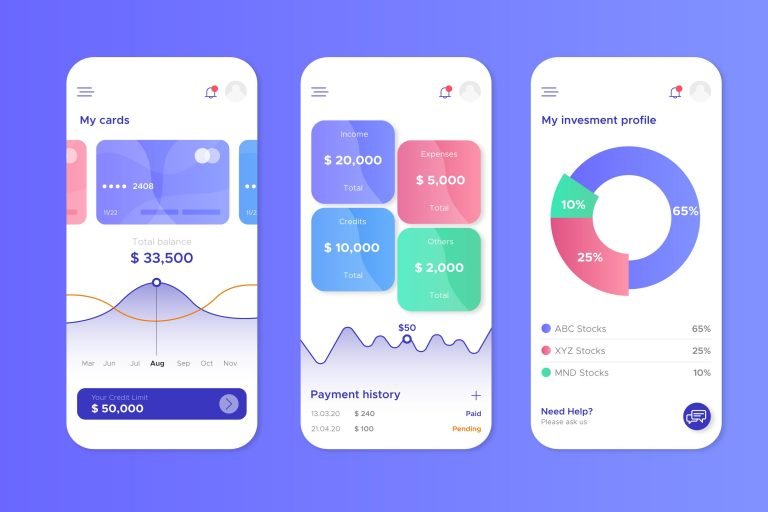

In order to manage your money effectively, it is important to find the best expense tracker app. Expense tracker apps are simple to use and can help you track your spending, control unnecessary…

Health insurance in India is a crucial aspect of financial planning as it helps individuals and families cover the costs of medical expenses and treatments. Having health insurance provides a…

An account aggregator is a consent manager and a NBFC, licensed by RBI, that acts like a bridge between financial information providers and financial information users. Based on your “informed…

If you’re a beginner looking to get started in investing, equity mutual funds could be the way to go. These funds pool together money from multiple investors to invest in…

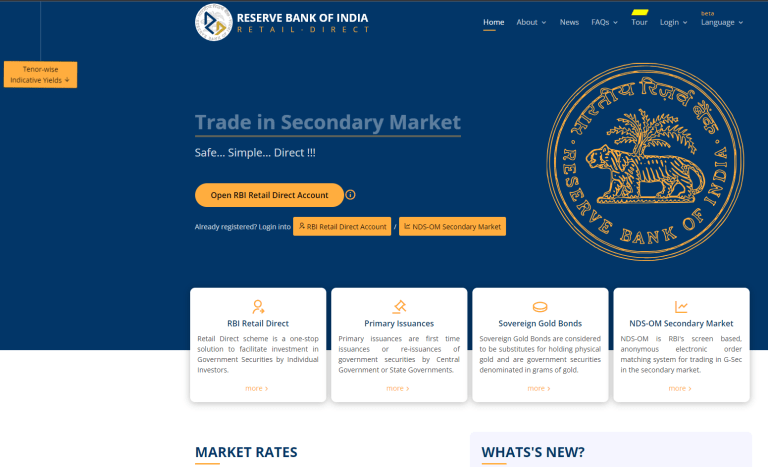

Key Takeaways Are you interested in opening an account in the RBI Retail Direct Portal? If so, you’ve come to the right place! In this comprehensive guide, we will take…

💡Key Takeaways: 🤔Why You May Not Need a Financial Advisor as a Millennial Let’s level with each other – DIY money management can seem complicated, even scary at times. Complex…

Key Takeaways Introduction Ever wonder why we often make less than optimal financial decisions, even when we have all the necessary information? Could these missteps be more than just mistakes?…