An account aggregator is a consent manager and a NBFC, licensed by RBI, that acts like a bridge between financial information providers and financial information users. Based on your “informed consent” they facilitate this sharing of information that could allow you to get a loan, manage your finances, or share financial updates with your financial planner or wealth manager.

Interestingly, an account aggregator does not have access to the user’s bank login information. Instead, the user gives the aggregator permission to access their account data. This is known as “informed consent.” By using an account aggregator, users can be sure that their financial information is safe and secure.

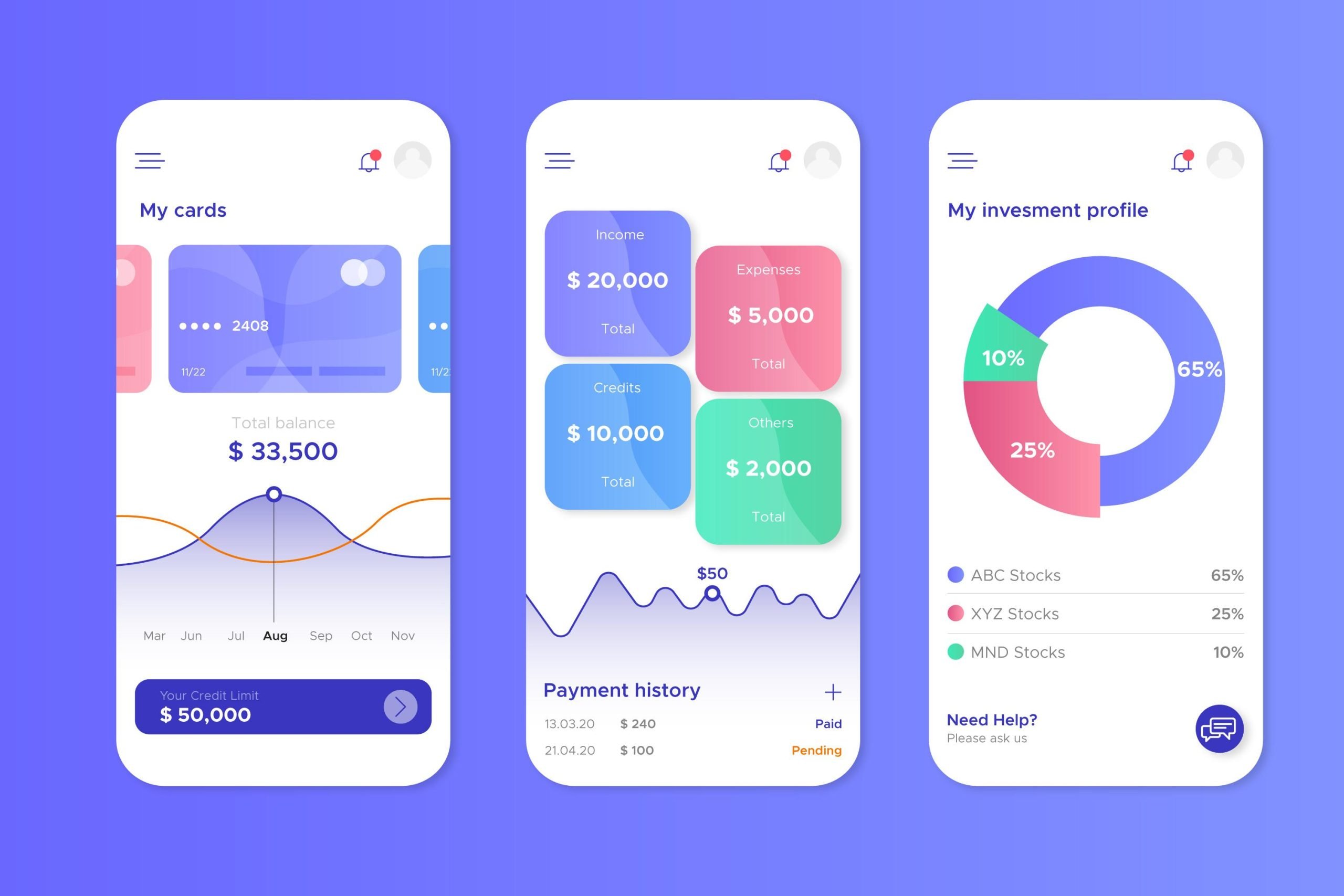

Picture from Sahmati.org.in showing the account aggregator network

Benefits of Using an Account Aggregator

- With an account aggregator, you can see all of your financial information in one place. This can help you make informed decisions about your finances and better manage your money.

- You can share your information including details of your income, net worth etc to a potential lender to procure a loan.

- You can share financial updates with your financial adviser before a review meeting to discuss your progress towards achieving your goals.

How to Get Started with an Account Aggregator

An account aggregator (AA) is a service that consolidates all of your banking, insurance and investment accounts in one place, so you can easily keep track of them. This can be a great way to stay organized and save time.

List of approved and active AAs can be found on the Sahamati website.

Informed consent is also an important consideration. Make sure you understand how the account aggregator will use your information before you sign up. You can customize which FIU has access to your data and for what period. This consent can also be revoked by you.

Once you’ve found a good account aggregator, getting started is easy. Simply create an account and add your existing online accounts. You will be required to provide your mobile number and PAN details. The account aggregator will do the rest, and you can start using it right away.

Steps for Setting Up an Account Aggregator Account

There are many different account aggregation services out there, so it can be tough to choose the right one. Here are a few steps to help you set up an account aggregator account:

1. Research the different account aggregation services. This will help you find the best one for your needs.

2. Create an account with the account aggregator service of your choice.

3. Connect your financial accounts to the account aggregator. This will allow the service to collect and organize your financial data.

4. Start using the account aggregator to view your financial information in one place. You can use it to track your spending, monitor your investment portfolio, and more.

5. Share your account aggregator data with your financial advisor, accountant, or other trusted professionals. This will help them give you better advice and make more informed decisions about your finances.

Sahamati’s website shows how to install and use the AA mobile and web apps.

What Are the Costs Associated with an Account Aggregator?

None. AA services are currently free for individual users. FIUs are required to pay-per-use and get certified for usage of the AA services.

However be aware that though many financial information providers (FIPs) have signed up with AAs most are yet to go live. This means that you can link some of your bank accounts, deposits, and few investments at this time.

Simplified Financial Management

You can simplify your financial life by using an account aggregator. All of your financial accounts can be connected in one place with an account aggregator. This includes your savings accounts and deposits, credit cards, investments, insurance and more.

The benefits of using an account aggregator are numerous. For one, it can save you time. Instead of accessing each individual account to verify balances, it is possible to view all of them in a single location. This can also help you avoid late fees and other penalties by staying on top of your bills.

Additionally, an account aggregator can help you keep track of your spending. By being able to see all of your transactions in one place, you can easily identify where your money is going. This can help you make better choices about your spending and make changes as needed.

Finally, an account aggregator can give you a better picture of your overall financial health allowing you to stay on track to achieve your financial goals.

Conclusion

The AA ecosystem is advancing and numerous FIUs are battling the technical hurdles associated with exchanging the massive information securely, individuals will find that the rewards outweigh the drawbacks.

It is worth signing up for the ability to have all of your financial information in one place, share that information with the FIUs you choose for the period you want, and access various accounts in one place and track them.

FAQs – Account Aggregator ecosystem

Let’s dive into some FAQs that’ll unravel this tech-savvy financial concept.

Q1: What exactly are account aggregators?

Think of account aggregators as your friendly data superheroes! They’re licensed entities authorized by the RBI to securely gather your financial information from various sources like banks, insurers, or mutual funds and present it in one place.

Q2: How do account aggregators work?

These wizards work with a ‘consent manager,’ ensuring your data stays protected. You give consent to these aggregators to collect your financial data from different sources. Then, they use their magic (secure tech, not a wand!) to fetch and organize this info into a single dashboard or app for your convenience.

Q3: What terms should I know in this RBI licensed account aggregator universe?

RBI: That’s our financial guardian, the Reserve Bank of India. Financial Data: It’s all about your money matters – transactions, accounts, assets, and more. Consent Manager: Think of them as gatekeepers managing your data permissions. FIP: Financial Information Providers, like banks, insurers, or mutual funds, holding your financial data. FIU: Financial Information User, entities using this data for services like loans or financial planning.

Q4: Why should I care about account aggregators? What’s in it for me?

Picture this: having all your financial data neatly organized in one place, giving you better control and a 360° view of your money matters. It’s like having your financial life sorted, helping you make smarter decisions.

Q5: Can you list the benefits of using account aggregators?

Absolutely! With account aggregators, you gain:

- Enhanced Financial Control: You decide who accesses your data.

- Convenience: Easy access to all financial info in one go.

- Improved Decision-Making: Clarity for better financial choices.

- Tailored Offerings: Services customized to your needs.