Are you struggling with credit card debt and looking for ways to effectively manage it? You’re not alone. Many people find themselves overwhelmed by steep interest rates, penal charges and mounting debt. But don’t worry, we’re here to help! In this article, we’ll share some expert tips that can help you regain control of your finances and tackle your credit card debt head-on.

Key Takeaways:

- Spend frugally, pay bills promptly, and reduce your balance each month to effectively manage credit card debt.

- Priority should be given to paying off the credit card with the highest interest rate first if you have multiple cards.

- Meeting minimum payments is crucial to avoid damaging your credit rating.

- Credit card debt carries high-interest rates and can lead to financial difficulties if not managed properly.

- Avoid making only minimum payments, as it can result in rapid accumulation of credit card debt.

The Downsides of Credit Card Debt

Credit card debt can have several significant downsides that can negatively impact your financial well-being. Understanding these downsides is crucial for managing your credit card debt effectively and avoiding financial difficulties.

High-Interest Rates

One major downside of credit card debt is the high-interest rates associated with it. In fact, credit cards often have higher interest rates compared to other forms of debt like home-equity loans or mortgages. These high-interest rates can make it challenging to pay off your debt and can result in rapidly accumulating balances, especially if you only make minimum payments.

Financial Difficulties

Excessive credit card debt is often an early sign of financial difficulties. If you find yourself relying on credit cards to cover everyday expenses or struggling to make your minimum payments, it may be an indication that your financial situation needs attention. High credit card debt can drain your resources, making it difficult to meet other financial obligations and potentially leading to a cycle of debt.

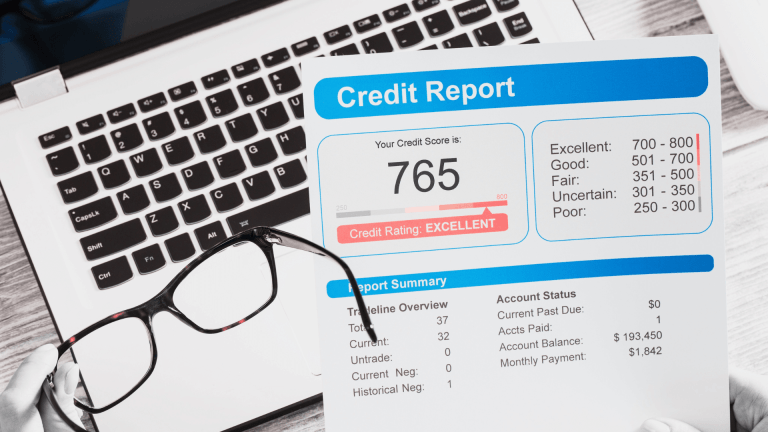

Negative Impact on Credit Score

Carrying a high credit card balance can also have a negative impact on your credit score. Credit utilization, which is the percentage of your available credit that you are currently using, plays a significant role in determining your credit score. If your credit utilization ratio is high due to credit card debt, it can lower your credit score and make it more challenging to access favourable interest rates on future loans or credit cards.

| Downside | Description |

|---|---|

| High Interest Rates | Credit cards often carry higher interest rates compared to other types of debt. |

| Financial Difficulties | Excessive credit card debt can be a sign of financial struggles and can make it challenging to meet other financial obligations. |

| Negative Impact on Credit Score | Having a high credit card balance can lower your credit score and make it more difficult to access favourable credit terms in the future. |

It’s important to be aware of these downsides to credit card debt and take proactive steps to manage your debt effectively. By paying off your balance each month, avoiding excessive credit utilization, and seeking assistance if needed, you can minimize the negative impact of credit card debt on your financial well-being.

Strategies for Paying Off Credit Card Debt

When it comes to credit card debt, it’s important to have a plan in place to reduce your balance and regain control of your finances. By implementing the right strategies, you can pay off your credit card debt more efficiently. Here are some effective strategies to consider:

1. Pay More Than the Minimum

One of the most important things you can do to tackle credit card debt is to pay more than the minimum amount due each month. While making minimum payments may seem convenient, it can keep you trapped in a cycle of debt due to high-interest charges. By paying more than the minimum, you’ll reduce your balance faster and save on interest over time.

2. Prioritize the Highest Interest Rate First

If you have multiple credit cards with varying interest rates, it’s wise to prioritize paying off the card with the highest interest rate first. This approach, known as the debt avalanche method, helps you tackle the most expensive debt first, saving you money on interest eventually. By focusing your efforts on the highest interest rate card, you’ll make significant progress in reducing your overall credit card debt.

3. Consider Balance Transfers and Debt Consolidation

Another option to help pay off credit card debt is to explore balance transfers and debt consolidation. Balance transfers allow you to move your high-interest credit card debt to a card with a lower introductory or promotional interest rate. Debt consolidation, on the other hand, involves combining multiple credit card debts into a single loan with a lower interest rate. Both options can help simplify your repayment process and potentially save you money on interest.

| Strategies | Benefits |

|---|---|

| Pay more than the minimum | – Reduces balance faster – Saves on interest charges |

| Prioritize the highest interest rate | – Saves money on interest eventually – Reduces overall credit card debt |

| Consider balance transfers and debt consolidation | – Simplifies repayment process – Potentially lowers interest rates |

By implementing these strategies and staying committed to paying off your credit card debt, you’ll be on your way to financial freedom and improved peace of mind.

Tips for Responsible Credit Card Usage and Debt Management

When it comes to managing credit card debt, responsible spending and budgeting are key. By implementing a few smart strategies, you can take control of your finances and work towards paying off your credit card debt. Here are some tips to help you manage your credit card debt responsibly:

Create and Stick to a Budget

Start by creating a monthly budget that outlines your income and expenses. Be realistic and allocate funds for essential expenses like rent, utilities, groceries, and transportation. Set aside a portion of your income for savings and designate a specific amount for credit card debt repayment. This will help you prioritize your spending and avoid unnecessary purchases.

Avoid Impulse Buying

One of the main culprits of credit card debt is impulsive buying. Before making a purchase, ask yourself if it is something you truly need or if it’s a fleeting desire. Reduce the transaction limit and avoid auto-saving credit card data. Consider implementing a “cooling-off” period where you give yourself a certain amount of time, like 24 hours, to think about the purchase. This will help you make more deliberate buying decisions and prevent unnecessary credit card charges.

Pay Your Bills on Time

Paying your credit card bills on time is crucial for several reasons. Firstly, it helps you avoid late payment fees and penalty interest rates. Secondly, it helps you maintain a good credit score, which is important for future financial endeavours. Set up payment reminders or automatic payments to ensure you never miss a due date. If possible, pay more than the minimum payment each month to make progress in reducing your credit card debt faster.

| Benefits of Responsible Credit Card Usage and Debt Management |

|---|

| You gain control over your finances |

| You reduce the risk of accumulating more debt |

| You improve your credit score |

| You develop good financial habits |

By adopting responsible spending habits, creating a budget, and paying your bills on time, you can effectively manage your credit card debt and work towards a more secure financial future.

Options for Consolidating Credit Card Debt

Consolidating credit card debt can be an effective strategy to simplify repayment and potentially lower interest rates. There are two common options for consolidating credit card debt: personal loans and balance transfers. Each option has its own benefits and considerations. By understanding how these options work, you can make an informed decision that aligns with your financial goals.

Personal Loans

A personal loan is a type of loan that you can use to consolidate multiple credit card balances into a single loan with a fixed interest rate and monthly payment. This can provide the convenience of having only one payment to manage and potentially lower your overall interest costs. Personal loans typically have lower interest rates compared to credit cards, especially if you have a good credit score. However, it’s important to carefully review the terms and conditions of the personal loan, including any fees or penalties, to ensure it’s the right choice for you.

Balance Transfers

A balance transfer involves moving your credit card balances from one or more high-interest cards to a new card with a lower interest rate, often with an introductory 0% interest period. This can help you consolidate your debt and save money on interest charges. However, it’s essential to consider any balance transfer fees and the length of the introductory period. It’s crucial to aim to pay off the transferred balance within the promotional period to avoid high interest charges once the promotional period expires.

Comparing the Options

When considering which option is best for consolidating your credit card debt, it’s important to evaluate various factors, such as interest rates, fees, and the repayment timeline. Additionally, consider your financial situation and goals. Personal loans may be more suitable if you prefer a fixed repayment schedule and a potentially lower interest rate. Balance transfers can be beneficial if you want to take advantage of an introductory 0% interest rate and have a plan to pay off the balance within the promotional period. Take the time to compare the options, assess the costs and benefits, and choose the option that aligns with your needs.

| Option | Benefits | Considerations |

|---|---|---|

| Personal Loans | – Single monthly payment – Potentially lower interest rates – Fixed repayment schedule | – Fees and penalties – Creditworthiness affecting interest rates |

| Balance Transfers | – Potential for 0% interest period – Consolidation of debt – Savings on interest charges | – Balance transfer fees – Expiry of promotional period – Need for a repayment plan |

The Importance of Seeking Professional Help with Credit Card Debt

If you find yourself struggling to manage your credit card debt on your own, it’s important to know that you’re not alone. Seeking professional assistance can be a valuable step towards regaining control of your finances. Credit counselling services like Freed are available to provide guidance and support in navigating the challenges of credit card debt.

One of the key benefits of credit counselling is that they can negotiate with your creditors on your behalf. They have the expertise to potentially lower your interest rates and monthly payments, making it easier for you to repay your debt. By working with a credit counselling service, you may be able to establish a debt management plan.

A debt management plan consolidates your credit card debts into a single monthly payment. This can simplify your financial obligations and provide relief from the stress of managing multiple payments. Additionally, a debt management plan often comes with reduced interest rates and fees, helping you to pay off your debt more efficiently.

FAQ about managing credit card debt

How can I effectively manage credit card debt?

To effectively manage credit card debt, it’s important to spend frugally, pay bills promptly, and reduce your balance each month. Prioritize paying off the card with the highest interest rate 1st, and make sure to meet minimum payments to avoid damaging your credit rating.

What are the downsides of credit card debt?

Credit card debt carries exorbitant interest rates, can harm your credit score, and make it challenging to meet other financial obligations. Having a high credit utilization ratio can lower your credit score, and making only minimum payments can lead to rapidly accumulating debt.

How can I pay off credit card debt?

Paying more than the minimum is crucial to accelerate the repayment of credit card debt. Consider using the debt avalanche method to pay off the debt with the highest interest rate first or the debt snowball method to start with the smallest debt. Transferring balances to lower-interest cards or consolidating multiple card balances into a single debt with a lower interest rate can also be options to consider.

What are some tips for responsible credit card usage and debt management?

Practice responsible spending and budgeting by living within your means, cutting expenses where possible, and avoiding impulse buying. Pay credit card bills on time to prevent late fees and additional interest charges. Develop a realistic budget, track your spending, and consider using cash for daily purchases. Building an emergency fund can also prevent the need to rely on credit cards.

What options do I have for consolidating credit card debt?

You can consider taking out a personal loan or line of credit to pay off credit card balances at a lower interest rate. This can help convert high-interest credit card debt into a loan with a more manageable interest rate and fixed repayment schedule. Another option is to transfer balances from high-interest cards to lower-interest cards, often with introductory 0% interest rates. Be aware of any fees associated with balance transfers and aim to pay off the transferred balance within the promotional period to avoid high-interest charges.

Why is it important to seek professional help with credit card debt?

If you’re struggling to manage credit card debt on your own, professional assistance can be beneficial. Credit counselling services like Freed can offer guidance, help negotiate lower interest rates and monthly payments with creditors, and recommend a debt management plan. It’s important to choose a reputable credit counselling agency and explore all available options before committing to a debt management plan. Professional assistance can provide valuable support and guidance in effectively managing credit card debt.