Key Takeaways

- The RBI Retail Direct portal provides easy access, safety, and diversification options for investing in government securities.

- Opening an account in the RBI Retail Direct portal involves registering as an investor, completing the KYC process, and creating a user ID and password.

- The portal allows you to invest in various government securities, monitor your investments, and manage your portfolio conveniently.

- There are no fees or charges for opening an account in the RBI Retail Direct portal.

- Eligible NRIs can currently invest in government securities through the RBI Retail Direct portal.

- Opening an account in the RBI Retail Direct Portal requires a step-by-step process, including registration, verification, and linking a bank account.

- Investors can choose from a wide range of government securities available on the portal, including Treasury Bills, State Development Loans, and Fixed Rate Bonds.

- Before investing, it is important to understand the key features and risks associated with government securities.

- Investors can track their investments, view account statements, and receive electronic alerts through the portal, ensuring they stay updated on their investment portfolio.

- It is crucial to provide accurate and up-to-date information while opening an account and conducting transactions on the RBI Retail Direct Portal to ensure smooth and error-free operations.

Are you interested in opening an account in the RBI Retail Direct Portal? If so, you’ve come to the right place! In this comprehensive guide, we will take you through all the necessary steps, benefits, frequently asked questions, and key takeaways to help you navigate the process with ease. Whether you’re a first-time investor or someone looking to diversify your portfolio, this guide will provide you with the essential information you need to get started.

Understanding the RBI Retail Direct Portal

The RBI Retail Direct Portal is a platform offered by the Reserve Bank of India (RBI) that allows individuals to invest directly in government securities. This online portal provides a convenient and efficient way for retail investors to participate in the government securities market and enjoy the benefits that come with it.

Benefits of Opening an Account in the RBI Retail Direct Portal

Opening an account in the RBI Retail Direct Portal offers numerous benefits for retail investors. Here are some key advantages to consider:

1. Direct access to government securities

Through the RBI Retail Direct Portal, investors gain direct access to government securities, including treasury bills and dated securities. This platform enables individuals to invest directly in these secure instruments, eliminating the need for intermediaries or brokers. By investing directly, investors can potentially save on fees and enjoy greater control over their investment decisions.

2. Diversification and risk management

Investing in government securities can be an effective way to diversify your investment portfolio and manage risk. These securities are considered relatively safe as they are backed by the government’s creditworthiness. By adding government securities to your investment mix, you can potentially reduce the overall risk in your portfolio and enhance its stability.

3. Competitive interest rates

The RBI Retail Direct Portal offers competitive interest rates on government securities, making it an attractive option for investors seeking income-generating investments. Government securities typically provide fixed interest payments at regular intervals, which can be beneficial for individuals looking for a reliable and passive source of income.

4. Accessibility and convenience

The RBI Retail Direct Portal provides investors with a convenient platform to invest in government securities. It eliminates the need for physical paperwork and allows investors to transact online from the comfort of their homes or offices. This accessibility and convenience make it easier for individuals to participate in the government securities market, regardless of their location.

5. Transparency and security

Investing through the RBI Retail Direct Portal ensures transparency and security. Investors can access real-time information about the securities they hold, including their current valuations and transaction history. Additionally, since the platform is regulated by the Reserve Bank of India, investors can have confidence in the security and integrity of their investments.

6. Flexibility in investment amounts

The RBI Retail Direct Portal offers flexibility in investment amounts, allowing individuals to start with a minimum investment of INR 10,000. This makes government securities accessible to a wide range of investors, including those with smaller investment budgets. Furthermore, investors can choose from various tenors and coupon payments to align their investments with their financial goals and preferences.

7. No transaction charges

One significant advantage of using the RBI Retail Direct Portal is the absence of transaction charges. Unlike traditional brokers or intermediaries, the RBI does not charge investors any fees for transacting through the portal. This cost-saving feature can add significant value to your investments over time.

8. Long-term investment potential

Government securities are well-suited for long-term investment horizons. These securities can also be used for goals which have a fixed timeline.

9. Opportunities for retail investors

The RBI Retail Direct Portal aims to promote and facilitate retail participation in government securities. By opening an account in this portal, retail investors gain access to an asset class traditionally dominated by institutional investors. This democratization of investing allows individuals to benefit from the attractive returns and stability offered by government securities.

10. Ideal for investors requiring passive income

Investing in short-term government securities is ideal for investors requiring liquidity while long-term securities, though subject to interest-rate volatility and reinvestment risk, is ideal for investors who require a passive income.

Eligibility Criteria for Opening an Account

To open an account in the RBI Retail Direct portal, you need to meet certain eligibility criteria. These criteria ensure that only eligible individuals can access the benefits and services offered by the platform. Here are the key eligibility criteria you need to fulfil:

- Citizenship: You must be a citizen of India to be eligible for opening an account in the RBI Retail Direct portal. This restriction ensures that the benefits of the platform are available to Indian residents.

- Age Limit: The minimum age requirement to open an account is 18 years. This ensures that individuals opening an account have attained adulthood and are legally capable of entering into a financial agreement.

- KYC Compliance: The RBI Retail Direct portal follows the Know Your Customer (KYC) norms, which require you to provide certain documents and information to verify your identity and address. The KYC process helps in preventing fraud and ensures the security of the platform. Make sure you have the necessary documents, such as Aadhaar card, PAN card, and utility bills, to complete the KYC process.

- Bank Account: To participate in the RBI Retail Direct Scheme, you must have an active bank account in your name. This account will be linked to your RBI Retail Direct account for seamless transactions and fund transfers.

- Access to Internet Banking: It is important to have access to internet banking facilities to operate your RBI Retail Direct account efficiently. This ensures that you can easily access and manage your account online, make transactions, and stay updated with the latest information and notifications.

- Compliance with RBI Guidelines: You must adhere to the guidelines set by the Reserve Bank of India (RBI) regarding investment limits, minimum investment amount, and any other regulations related to the RBI Retail Direct Scheme. Familiarize yourself with these guidelines to ensure compliance.

It is essential to meet all the eligibility criteria mentioned above before proceeding with the account opening process. Failure to meet any of these criteria may result in your application being rejected or your account being suspended.

To ensure a smooth account opening process, make sure you have all the necessary documents and meet the eligibility criteria. Once you meet these criteria, you can proceed with the account opening process and start enjoying the benefits and services offered by the RBI Retail Direct portal.

Step-by-Step Guide: Opening your RBI Retail Direct (RDG) Account

Registering for an account is the first step to accessing the RBI Retail Direct Portal and enjoying all its benefits. This section will guide you through the registration process, ensuring that you have a smooth and hassle-free experience.

Step 1. Visit the RBI Retail Direct Portal

To begin, navigate to the RBI Retail Direct Portal website using your preferred web browser. The portal can be easily accessed on both desktop and mobile devices, ensuring flexibility and convenience for all users.

Step 2. Click on the “Register” Button

Once you are on the RBI Retail Direct Portal homepage, locate the “Open RBI retail direct account” button, usually displayed prominently on the home page. Clicking on this button will initiate the registration process.

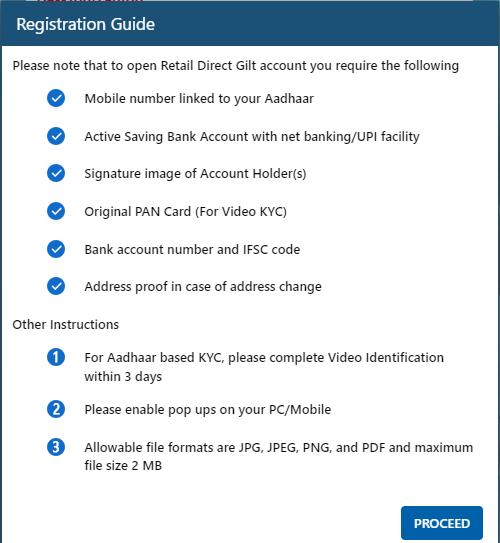

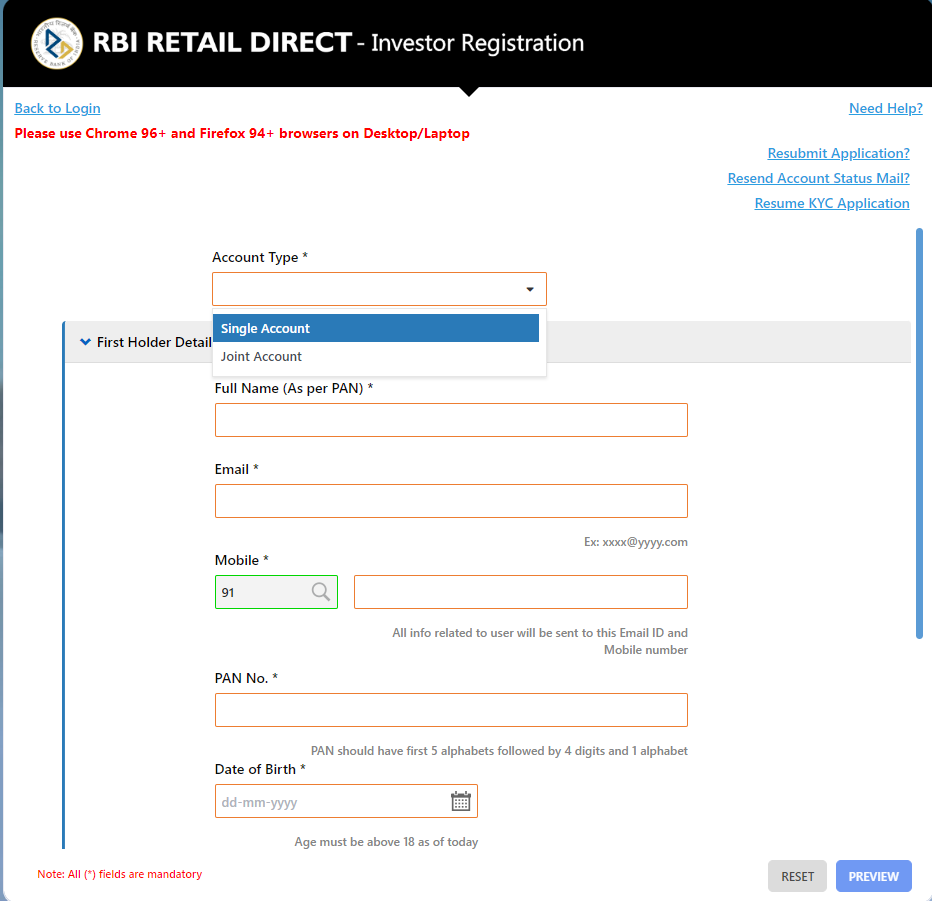

Step 3. Provide Personal Information

You will be directed to a registration form where you are required to provide your personal information. This includes details such as your full name, date of birth, residential address, contact number, and email address. Ensure that you enter accurate information that matches your official documents to avoid any complications in the future.

Be ready with the information required for the application as mentioned in the registration guide.

Step 4. Choose type of account: Single Account or Joint Account

You will get an option to either open a single holder or a joint holder account. In case you choose the Joint holder option, the first holder will be considered the Primary holder of the account.

Both the holders, in case of a joint account, will need to complete the registration process on the portal.

Next, you will be prompted to set up a unique username and strong password for your account. Choose a username that is easy for you to remember but difficult for others to guess. Create a strong password using a combination of uppercase and lowercase letters, numbers, and special characters. Remember to keep your login credentials safe and do not share them with anyone.

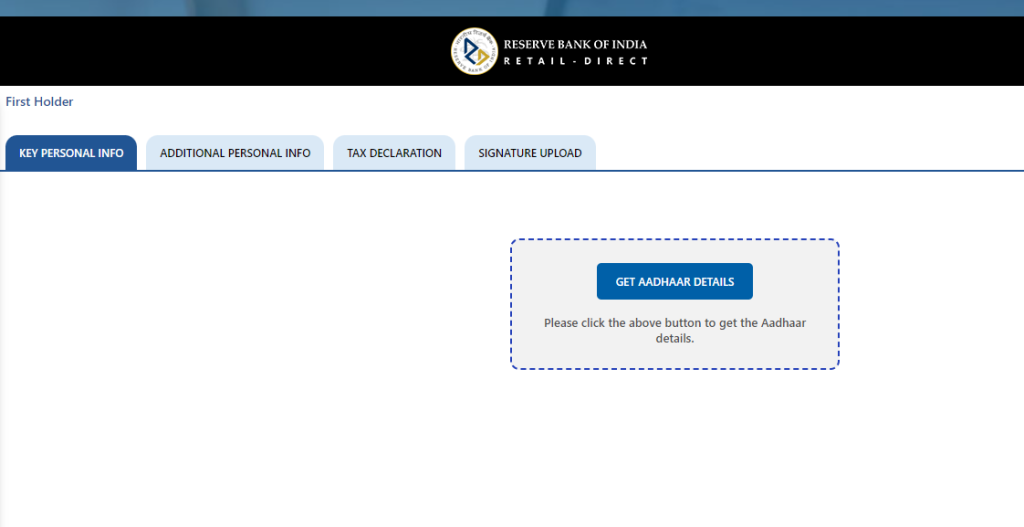

Step 5. Enter Aadhaar Card Details

The RBI Retail Direct Portal requires you to link your Aadhaar card for verification purposes. The Aadhaar verification will be done through your Digilocker account

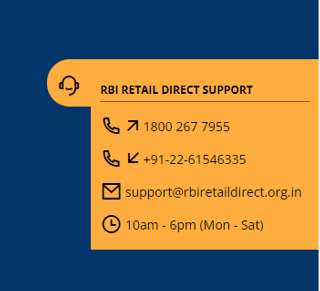

If you get stuck at any point or need help with your application, reach out to the RBI Retail Direct support team on phone or email.

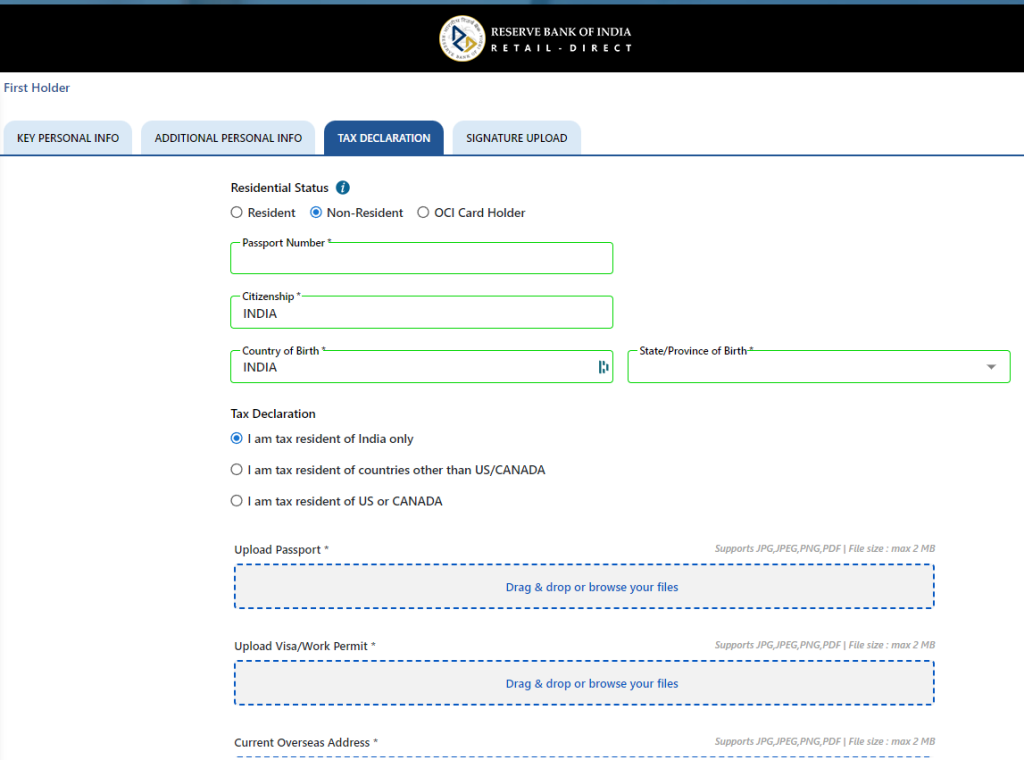

Step 6. Residential Status and Tax Residency

Next, you will be prompted to provide information regarding your occupation and annual income.

You need to enter your residential status information in this step. If you’re a Non-Resident, you must upload the relevant pages of your passport as well as copies of visa/work permit in this section.

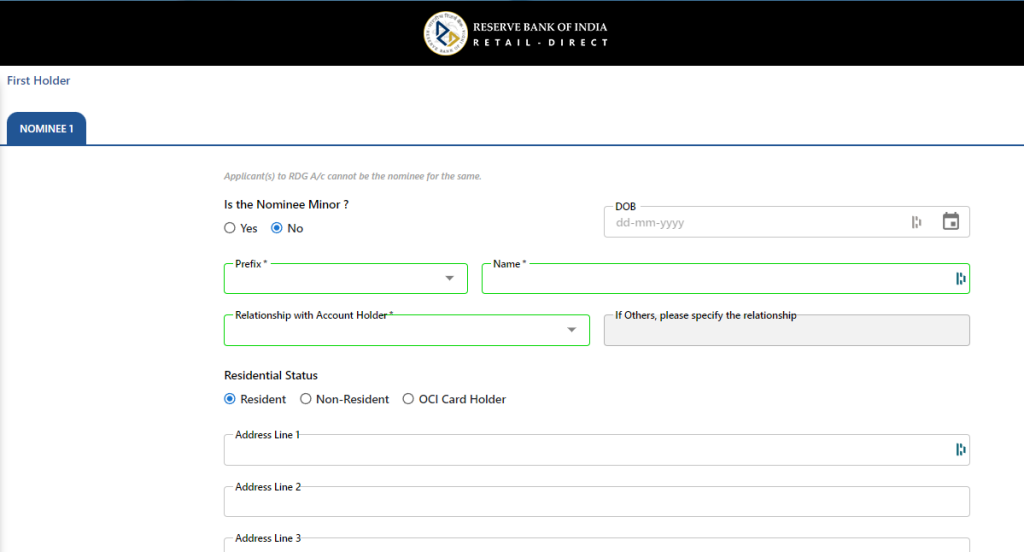

Step 7. Signature Upload & Nomination

The next step is to upload a scanned image of your signature, enter your bank account details as well as details of your nominee/s.

Step 8. Accept Terms and Conditions

Before completing the registration, carefully read and accept the terms and conditions of the RBI Retail Direct Portal. It is crucial to understand the rules and regulations governing your account to make the most of the services offered. You will be prompted to e-sign the application using Aadhaar OTP.

Step 9. Confirmation of Registration

After successful e-signing of the application, you will get an email from the portal confirming the same.

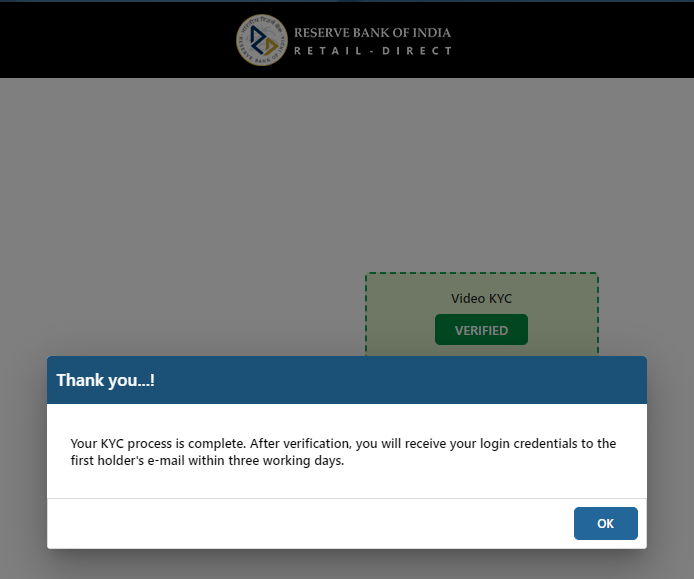

Step 10. Video KYC

The next step is to do the video KYC immediately or schedule one at your convenience.

At the appointed time, an agent assigned to you will ask a few questions and ask you to hold up your original PAN card to the webcam.

You will get a confirmation on the screen that your Video KYC has been completed. In case of NRIs, this process is done through CKYC. Ensure that your CKYC is updated.

Though the pop-up above mentions activation within three days, your RDG account is likely to be activated within 24 hours.

Congratulations on your new RDG account

Once you get your RDG account approval email, login and change your password. You will also be asked to confirm the nomination details that you had filled during application.

Remember to keep your login credentials secure and update your account information if there are any changes in the future. The RBI Retail Direct Portal provides a user-friendly interface and a range of services to enhance your investment experience. Explore the portal thoroughly and make the most of the opportunities it offers.

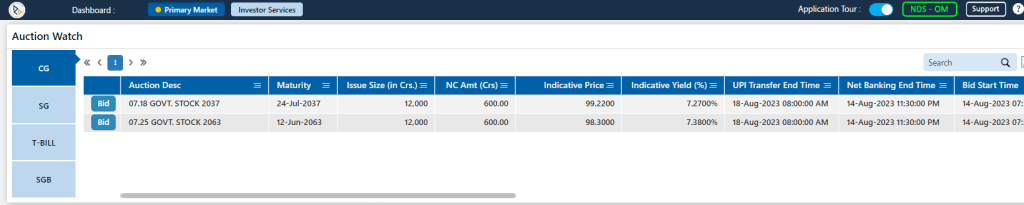

Account Dashboard

After logging in, the dashboard features the Primary market button on the top left. Here, you can view various government securities that are currently being auctioned.

FAQs About Opening an Account in the RBI Retail Direct Portal

Opening an account in the RBI Retail Direct Portal is a straightforward process that allows individuals to invest directly in government securities. However, you may have some questions or concerns before getting started. In this section, we address some of the frequently asked questions about opening an account in the RBI Retail Direct Portal.

- Who is eligible to open an account in the RBI Retail Direct Portal?

Any individual resident in India and eligible NRIs can open an account in the RBI Retail Direct Portal. However, minors are not eligible to open an account directly. They can invest through a guardian or a parent who has an account.

- How can I open an account in the RBI Retail Direct Portal?

To open an account, you need to visit the RBI Retail Direct Portal website and follow the steps outlined in our earlier section on “Step-by-Step Guide to Opening an Account in the RBI Retail Direct Portal.” It involves providing personal information, including your PAN (Permanent Account Number) and Aadhaar number, verifying the account through e-KYC, and linking a bank account.

- Do I need to have a demat account to open an account in the RBI Retail Direct Portal?

No, you do not require a demat account to open an account in the RBI Retail Direct Portal. The government securities purchased through this portal will be held in a non-demat form, known as the Subsidiary General Ledger (SGL) account.

- Can I have multiple accounts in the RBI Retail Direct Portal?

No, an individual can have only one account in the RBI Retail Direct Portal. This is to ensure transparency and prevent any misuse of the system. If you already have an account and wish to open another one, you will be required to close your existing account first.

- Are there any charges or fees associated with opening an account?

No, there are no charges or fees for opening an account in the RBI Retail Direct Portal. The account opening process is free of cost.

- Is there a minimum investment amount requirement?

Yes, there is a minimum investment amount requirement. Currently, the minimum amount is set at ₹10,000, and all investments made through the RBI Retail Direct Portal need to be in multiples of ₹10,000. In case of SGBs, the minimum purchase is 1gm of gold and in multiples of 1gm thereafter.

- Can I make additional investments in my account after opening it?

Yes, once your account is opened, you can make additional investments in government securities through the RBI Retail Direct Portal. There is no maximum limit on how much you can invest, provided it is in multiples of ₹10,000.

- What are the modes of payment available for making investments?

You can make investments through the RBI Retail Direct Portal using multiple modes of payment, including internet banking, UPI (Unified Payments Interface), RTGS (Real-Time Gross Settlement).

- What happens if I forget my login credentials?

If you forget your login credentials, you can use the “Forgot Password?” option on the login page of the RBI Retail Direct Portal. It will guide you through the process of resetting your password.

Opening an account in the RBI Retail Direct Portal is a convenient way for individuals to invest in government securities. By addressing your concerns and providing easy access to government bonds and treasury bills, the RBI Retail Direct Portal aims to democratize investing and empower retail investors in India.

The RBI Retail Direct Portal offers individuals a convenient and secure platform to invest in government securities. Opening an account in the portal involves a simple step-by-step process, and investors can enjoy various benefits such as easy access to government securities, competitive interest rates, and transparency. By providing accurate information, monitoring investments, and staying informed, investors can maximize their returns and achieve their financial goals.