Financial fraudsters are continuously refining their abilities, developing inventive strategies, and exploiting state-of-the-art tools to unlawfully acquire the well-deserved wealth of others.

But there’s no need to panic! 😊 By being aware and taking some simple precautions, you can keep your finances safe. In this detailed post, let’s talk about how to recognize and deal with financial fraud.

🕵️♀️ 1. Recognizing Phishing and Scams

The first step is recognizing shady behavior when we see it! Here are some common signs that something fishy (or phishy 🐟) is going on:

- Unsolicited messages: Random calls, emails, SMS with urgent requests for personal details or to “verify account” are red flags. Banks don’t ask for sensitive information like this over phone/email. Delete such messages!

- Spoofed senders: Check the sender’s email address or caller ID carefully. Fraudsters often use names that look similar to banks, credit card companies or government agencies.

- Spelling/grammar errors: Legitimate businesses don’t send such shoddy messages!

- Requests for immediate action: Scammers want to rush us into mistakes. Take time to verify any unusual requests, no matter how urgent they sound.

- Too good to be true offers: Extremely high returns, cheap loans, prize winnings, bonuses…be suspicious of such “great deals”.

- Threats or warnings: Scare tactics of account closure or penalties unless immediate action taken are also common tricks. Stay calm and verify officially.

The NPCI website lists do’s and dont’s on various fraud trends that you should be vigilant against.

2. Protecting Personal Information and Passwords from Financial Fraud 🔒🔑

- Never share Aadhaar/PAN details, etc. unless absolutely necessary while initiating any financial transaction.

- Use strong and unique passwords, change them frequently, and enable two-factor authentication wherever possible.

- Don’t use public WiFi or shared devices to access financial apps/sites. Use VPN if accessing on the go.

Here’s a handy table summarizing tips to recognize and avoid common scams:

| Scam Type | Red Flags | Protection Tips |

|---|---|---|

| Phishing | Suspicious sender, spelling errors, threats, urgent requests for personal info | Verify sender, delete message |

| Vishing | Unsolicited calls asking for OTP or account details | Hang up, call bank from official number to confirm if any issue |

| Fake customer care numbers | Numbers found via internet searches, caller ID spoofing | Cross-check on official website before calling back |

| Malware downloads | Attachments or links in emails/messages from unknown senders | Don’t open attachments or click links from unknown senders |

| Ponzi schemes | Promise of unusually high returns, pressure to invest quickly | Check company credentials, avoid “too good to be true” offers |

| Pyramid/Multi-Level Marketing schemes | Requirement to get others to join scheme and pay | Understand revenue model, check if focused on recruitment over actual product/service |

| Work from home scams | Jobs asking for upfront payment for “training” or “kit” | Never pay money upfront for a job. Seek trusted referrals. |

| Pay for likes scam | Promise of monetary rewards for liking or sharing content on social media | Be skeptical of such offers, avoid sharing personal information or payment |

Staying alert about these signs can prevent you from getting tricked by fraudsters!

🚨 2.1 Reporting Cybercrime

If you do fall prey to a financial scam, it’s vital you take quick action to minimize losses and prevent the crooks from striking again. Here are the steps to report different types of fraud:

2.2 Banking and Credit Card Fraud 🏦💳

- File a police complaint at the nearest cybercrime cell at the earliest. Obtain an FIR copy.

- Immediately notify the bank branch or credit card company helplines. Follow up with a written complaint letter. Provide FIR details.

- Report the fraud to the Banking Ombudsman of RBI within 30 days. Complaint can be filed online at Banking Ombudsman Scheme.

- Report credit card fraud to the National Cyber Crime Reporting Portal.

2.3 Mobile Wallet and UPI Fraud 📱💰

- Report unauthorized transactions to the wallet provider or UPI app’s customer care. Enable account blocks.

- Lodge an FIR with cybercrime cell.

- Notify issue via the NPCI Fraud and Risk Management team.

- Report details on the National Cyber Crime Reporting Portal.

- File a complaint with Nodal Officers of DFS, Ministry of Finance.

2.4 Online Shopping and E-commerce Fraud 🛍️💻

- Inform the online shopping website or e-commerce platform immediately, and provide transaction details.

- Approach the National Consumer Helpline for guidance and to resolve the issue.

- Lodge an FIR at the cybercrime police station. Submit on the National Cyber Crime Reporting Portal.

- Report fraudulent sellers to websites like flipkart.com, amazon.in, etc.

Acting quickly can help recover stolen money and restrict damage. Do not feel embarrassed or ashamed to report if you are a victim. The crooks are to blame, not you!

3. Recovering from Fraud 🔄💪

If money is stolen from our accounts due to fraud, these steps can help in getting it back and securing ourselves further:

- Dispute unauthorized transactions: Financial institutions will have fraud dispute processes. Follow prescribed procedures and provide transaction details, account statements, FIR copy, Aadhaar and PAN details, etc. as proof.

- Cancel compromised cards/accounts: Banks will block affected cards, wallets, accounts and issue new ones with changed account numbers to protect from future misuse.

- Change passwords: Use a password manager like Bitwarden, Dashlane or 1password.

- Create a strong master password of 4 – 6 words using Diceware. Utilize a password manager to generate secure and distinctive passwords for every account, with a particular emphasis on financial platforms such as online banking, wallet applications, and linked email and social media accounts.

- Enable 2FA: Protect your accounts with an added layer of security by activating two-factor authentication (2FA). Safeguard your email, social media, and cloud storage accounts by utilizing reliable apps like Google Authenticator or by employing a physical Yubikey.

- Update PII details: If sensitive info like Aadhaar, PAN details are compromised, report to issuing agencies to change linking. Submit the FIR details.

- Track credit report: Keep monitoring credit report from CIBIL/Experian every 3–4 months for any unauthorized credit accounts or loans applied using your name. Dispute immediately if found.

- Seek legal counsel: For large fraud amounts, consider hiring a lawyer or approaching consumer/cybercrime expert lawyers to assist with complaints and recovery process.

4. Step-by-Step Guide to Report Cybercrime on the National Cyber Crime Portal

- Go to the National Cyber Crime Reporting Portal at https://cybercrime.gov.in

- Click on “File a Complaint” and select complaint category (financial fraud, policy violation, etc.).

- Provide basic personal details like name, contact info, description of complaint, supporting documents.

- Note down and save the complaint number or print/save the acknowledgement form.

- A notification will be provided via email/SMS on complaint status.

- If local police action is required, the complaint may be forwarded to the respective state cyber crime cell.

- The complainant can track complaint status and interact with the nodal officer via email for redressal updates.

5. FAQs on financial fraud ❓💡

- How much time do I have to dispute fraudulent transactions?

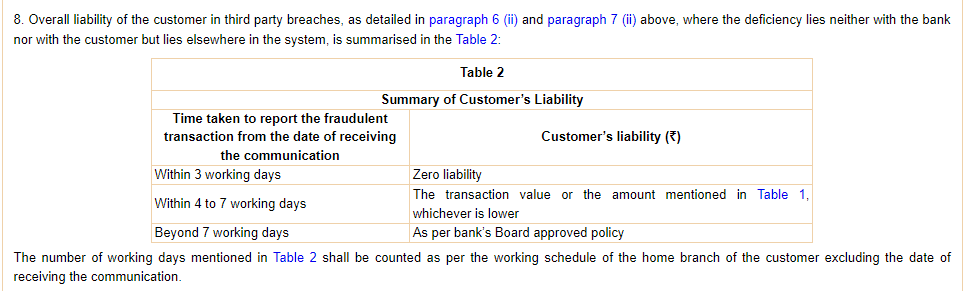

Dispute as soon as possible, ideally within 2–3 days as per RBI norms. The longer you delay, the lower the chances of recovering money.

2. What documents do I need to provide in a dispute?

- Original complaint letter with incident details

- Account statement showing unauthorized transactions

- First Information Report (FIR)

- Aadhaar and PAN details

- Any other proof requested by bank, card company, etc.

3. What happens in the dispute process?

The financial institution will investigate, retrieve payment details, verify forged signatures or one-time passwords used, check site/location of unauthorized transactions, etc. This may take 30–45 days after which they will provide a resolution.

4. What if my dispute claim is rejected?

First, ask the institution for detailed reasons for claim rejection and then provide any additional evidence you may have to support your case. If you are not satisfied, approach the nodal or grievance officer of the bank.

The list of Nodal officers of three major banks is available here: State Bank of India, HDFC Bank, and ICICI Bank. If you are still not satisfied, approach the banking ombudsman or consumer court.

5. How can I prevent future frauds?

- Be careful, especially with sharing personal details.

- Use credit monitoring or identity theft protection services.

- Set up SMS/email alerts for transactions.

- Monitor account statements regularly for unauthorized activity.

- Be proactive in managing risks and taking steps to be cyber secure.

6. Conclusion

Scams and frauds might seem intimidating, but with a few precautions, you can safely enjoy the benefits of online banking. Stay alert, report any suspicious activities immediately, and persistently follow up with your bank to recover any losses. This will help keep your finances secure.

Stay smart, stay secure! 😎 Let me know in the comments if you have any other tips or questions on avoiding financial fraud. I’d be happy to help!