I. Introduction to personal financial planning

Personal financial planning, in simple terms, is the process of managing one’s finances to achieve their set financial goals. It includes creating a budget, establishing financial objectives and making sound investment and monetary decisions.

Mid-career salaried professionals and their families face a number of financial risks. These include:

II. Identifying Risks in personal financial planning

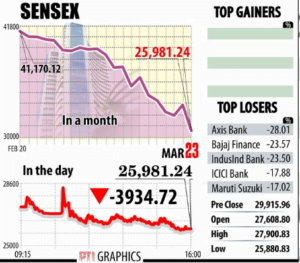

A. Market risks from investments and currency fluctuations: Market risks refer to the uncertainty and volatility of the value of investments. This includes changes in stock prices, bond yields, and other securities. Currency fluctuations can also make international investments more volatile. Market risks also include the impact of economic downturns, which can decrease the overall value of investments.

B. Inflation risks from lifestyle inflation and consumer price inflation: Inflation risk refers to the erosion of the purchasing power of money due to the increase in prices over time. Lifestyle inflation is when an individual increases their spending as their income increases, which can make it difficult to save and meet long-term financial goals.

Consumer price inflation, on the other hand, refers to the general increase in prices of goods and services in an economy, which can also affect an individual’s purchasing power. This risk is particularly important to consider when it comes to long-term financial planning, as inflation can erode the value of savings and investments over time.

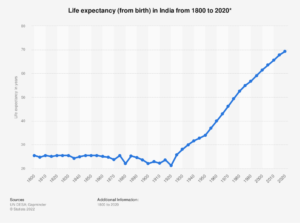

C. Longevity risk from outliving income and savings: Longevity risk refers to the risk that an individual might outlive their income and savings. This can occur if an individual does not have enough saved for retirement or if the individual’s retirement savings do not provide enough income to cover their expenses in old age. This risk is becoming more prevalent as people are living longer.

Average life expectancy in India was 70 years in 2020. Life expectancy is higher in urban areas and among the richest 20% of households in India the average life expectancy is nearly 74-76 years. In other words, by the time you retire, couples spending 30 plus years in retirement will be quite common.

D. Health risks from medical expenses and disability: Health risks can include unexpected medical expenses and the potential for disability, which can lead to a loss of income. These risks can be costly, particularly if an individual is not covered by health insurance.

Though private sector employees have access to employer group insurance, these schemes do not provide employees with any health insurance cover during transition between jobs or in their retirement.

E. Legal risks from taxes, insurance policies, and other contracts: Legal risks can include taxes and other legal obligations, as well as issues related to insurance policies and other contracts. These risks can be difficult to anticipate and may have a significant impact on personal finances.

Examples of legal risks include tax penalties for not correctly reporting income, disputes arising from not understanding the terms of a contract, property rights disputes, or disputes over estate planning.

F. Family dynamics risks from marriage, divorce, death, etc.: Family dynamics risks refer to the potential financial impact of unexpected events such as marriage, divorce, death, or other major life changes that can have a significant impact on personal finances. Examples include disputes over inheritance, division of assets in a divorce, or the loss of a breadwinner in a family.

III. Risk management in personal financial planning

A. Diversification of investments to reduce market risk: One way to manage market risks is to diversify investments across different types of assets, such as equity, debt, and real estate. This can help to spread risk and reduce the impact of any one investment on the overall portfolio.

Align your investment portfolio to your risk profile, risk capacity and your risk knowledge. An asset allocation based on your risk tolerance, goals and timeline for investment can allow you to achieve a balance in your investments.

B. Planning for retirement to mitigate longevity risk: Planning for retirement can include saving for retirement, investing in a pension plan, contributing to defined contribution plans, and purchasing an annuity. This can help to ensure that income and savings will last throughout retirement.

C. Purchasing health insurance to cover medical expenses and disability costs: Health insurance can help to mitigate the risks associated with unexpected medical expenses and disability by providing coverage for these costs.

D. Understanding tax laws and other legal obligations: Understanding tax laws and other legal obligations can help to mitigate legal risks by ensuring that all taxes and other obligations are paid on time and in full.

Estate planning allows the smooth transition of assets to the beneficiaries while the family is recovering from loss due to the death of the head of the family.

E. Establishing family communication plans to address family dynamics issues: Establishing open lines of communication within a family can help to mitigate family dynamics risks by addressing issues early on and making sure that everyone is on the same page.

F. Developing an emergency fund for unexpected expenses: An emergency fund can help to mitigate a variety of risks by providing a financial buffer for unexpected expenses.

IV. Conclusion

In summary, personal financial planning for mid-career salaried professionals and their families in India involves identifying and managing a variety of risks, including market risks, inflation risks, longevity risk, health risks, legal risks, and family dynamics risks.

By diversifying investments, planning for retirement, purchasing health insurance, understanding tax laws, establishing family communication plans, and developing an emergency fund, these risks can be mitigated, and personal finances can be better protected.

It is important to keep in mind that these risks are always evolving, and one should continuously review, re-evaluate and update the plans accordingly. By being aware of the various risks and taking steps to mitigate them, mid-career salaried professionals and their families in India can take control of their financial future and work towards achieving their financial goals.