How to complete your Asset-Map client questionnaire

Thank you for signing up as a client. Welcome to Begin Financial. Before you get started with your onboarding Asset-Map questionnaire, let’s take a look at what it is and…

Thank you for signing up as a client. Welcome to Begin Financial. Before you get started with your onboarding Asset-Map questionnaire, let’s take a look at what it is and…

Hey there! So, retirement planning, retirement savings, and retirement investments might seem a bit far off when you’re in your 30s or early 40s, right? But trust us, it’s super…

In today’s competitive world, financing higher education has become essential for a bright future. It’s our responsibility as parents to ensure that our children can access the best education possible….

Budgeting is an essential skill that helps individuals take control of their financial future, achieve their goals, and attain financial freedom. In this blog post, we’ll discuss budgeting in the…

In today’s fast-paced world, it’s essential to have a clear vision of our financial goals to create a secure future. This comprehensive guide will walk you through six simple steps…

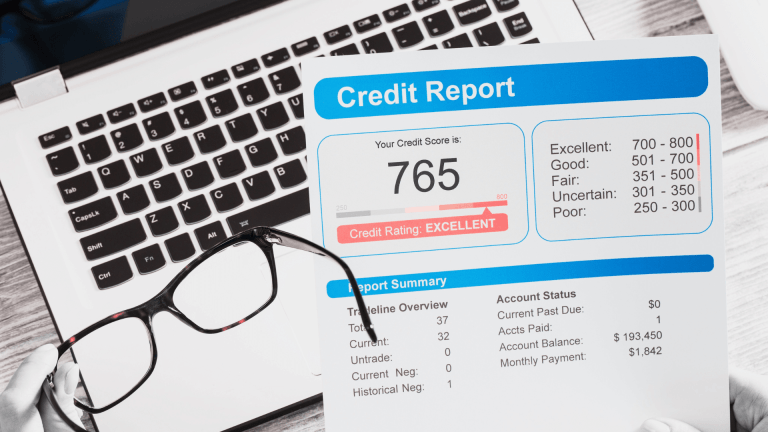

Introduction Having a good credit score is essential in today’s world, whether you want to buy a home, avail a loan, or apply for a credit card. Your credit report…

The new or alternative tax regime under Section 115BAC has undergone modifications in Budget 2023. What are the changes in the new tax regime? Finance bill 2023 has modified the…

SEBI released a report this month, featuring their analysis on the performance of individual traders in the equity futures & options (F & O) segment for the financial years 2019…

Introduction: Allocating to Debt investments in your portfolio As a salaried professional, it is important to have a well-diversified investment portfolio to achieve your financial goals. One of the ways…

I. Introduction to Asset Allocation Asset allocation is the process of committing your money in multiple asset classes like equity, debt, cash, real estate, to balance risk and reward. It…