Thank you for signing up as a client. Welcome to Begin Financial. Before you get started with your onboarding Asset-Map questionnaire, let’s take a look at what it is and why we use it.

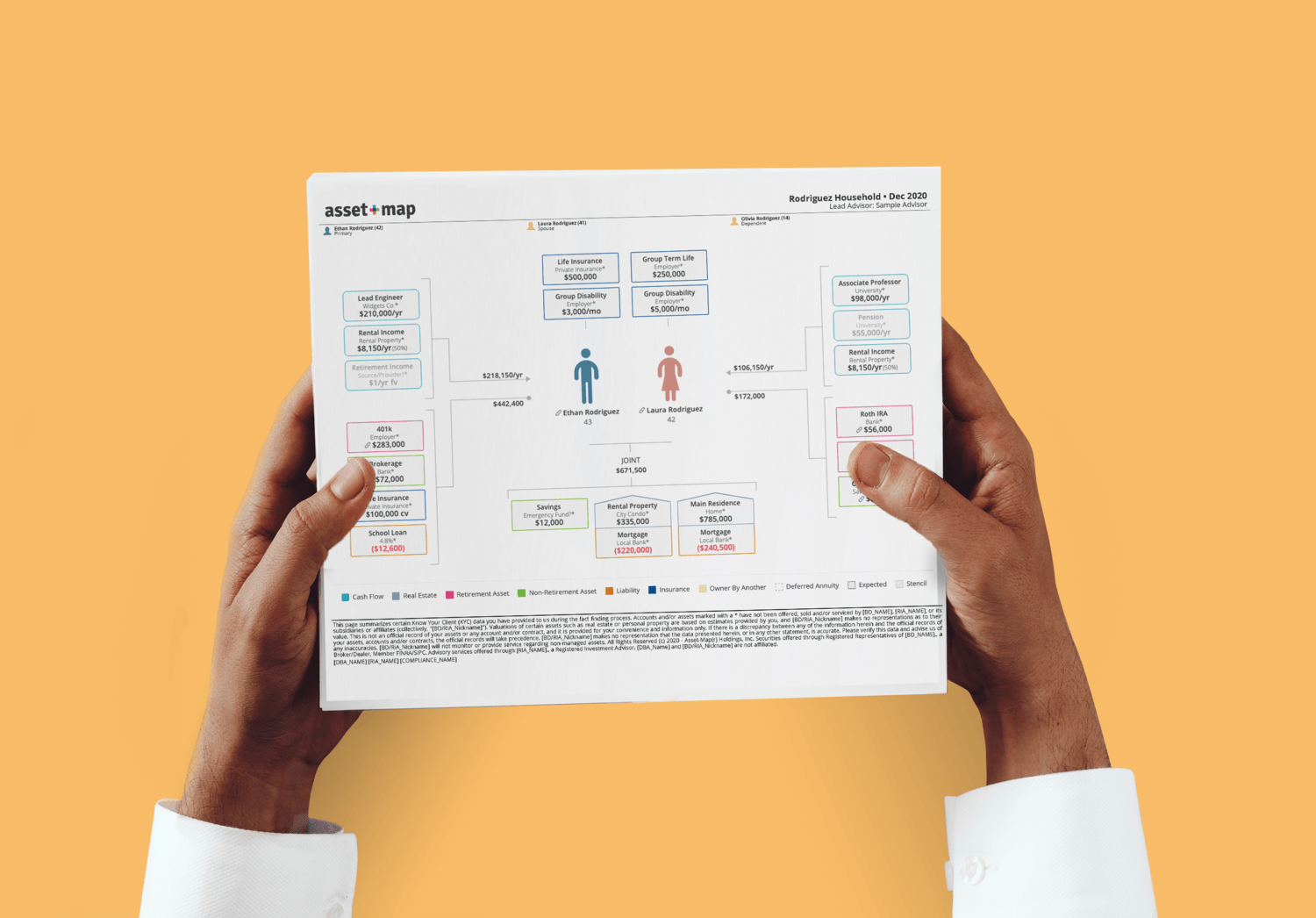

What is an Asset-Map?

It is an interactive financial planning tool that we use while providing our services to clients. During virtual meets, your investment advisor will share your Asset-Map with you. It provides visual cues on your current financial situation, financial goals, your net worth, helps you prioritize your goals and gives you a realistic view of your ability to achieve your financial goals. These are also available as client reports.

Why fill an online questionnaire?

We would like to know more about you, the important persons in your family, your current financial situation, the goals and objectives that are dear to you, and more. Asset-Map’s questionnaire allows you to provide all this information in less than 15 minutes. Besides, filling an online questionnaire is easier than sharing this information through other offline means.

Step-by-Step guide to filling up the Asset-map questionnaire

You can click the “learn more” option to look at a short video on Asset-Map or get started by clicking on the “start now” button.

Input Personal and relationship details in Asset-Map

Enter your details in the section above to get started. Once you have done that you can add the important people in your life in the next section.

From the dropdown menu, you can choose the relationship of this person as it applies to you. The person could be your spouse, a close family member, a dependent, an employer, your accountant or lawyer etc. You can add as many important people as you like.

The Asset-map questionnaire does not have a separate option to enter a “child”. You can add your child as a “dependent” and your advisor has the option available to later add the child’s relationship with you e.g. son, daughter, during your first discovery meeting with your advisor.

Similarly, in case you are entering details of your parents or in-laws, you can choose either family or dependent and then enter their details. Here too the advisor can enter the actual relationship later e.g. mother, father, mother-in-law, father-in-law etc.

The next section is where you can share your financial details. You can click on the icons that apply to your finances and click on the “continue” button.

Have as much of your financial details close by when you are starting this section on the Asset-Map questionnaire. Even if you miss out on any details, your advisor will go through these in your discovery meeting. Not to worry.

Input Financial details in Asset-Map

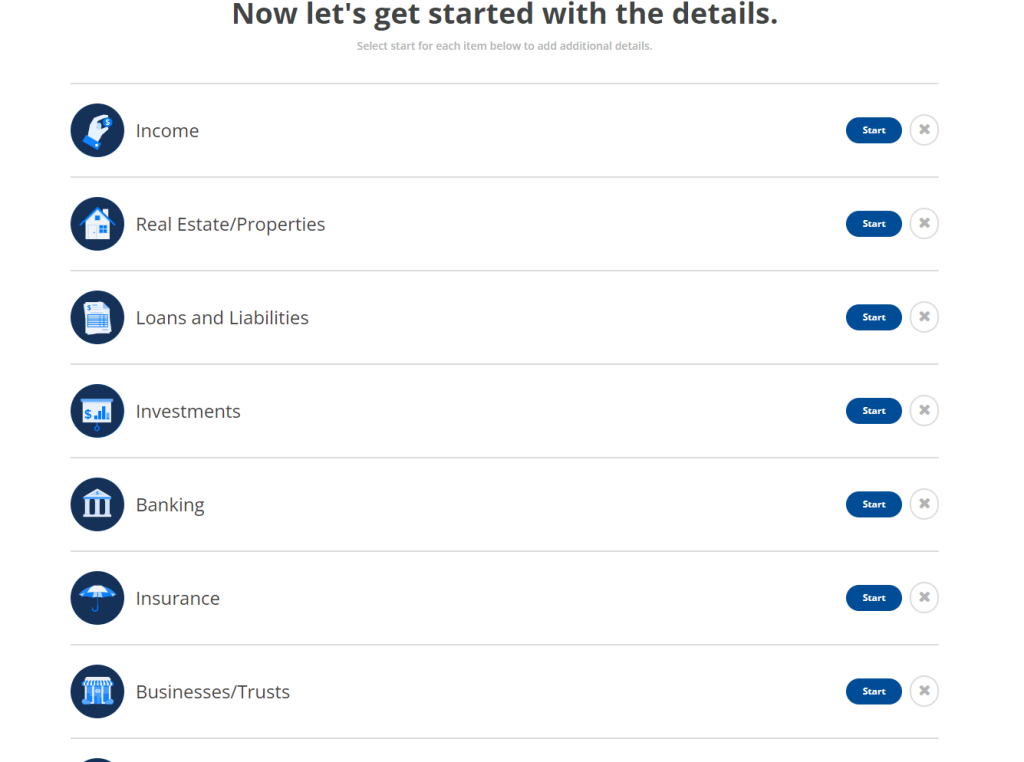

Depending on your icon choices, the next screen will allow you to start entering the details of your finances. click on “start” to start sharing these details.

On any screen clicking “back” will take you to the previous screen. You can make as many edits as you like before submitting the questionnaire.

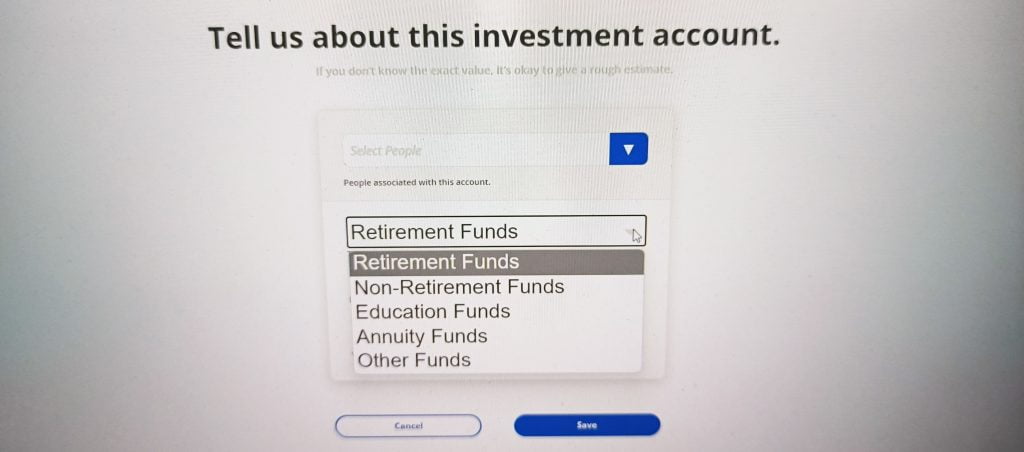

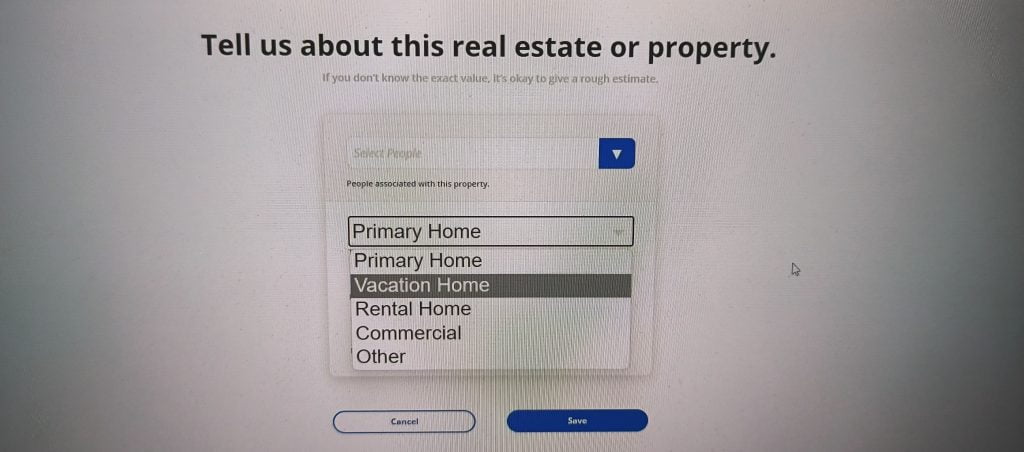

The dropdown menus in each of the financial sections allow you to enter financial details from various sub-sections in those categories as can be seen above or below. Each of the sections also allows you to link the financial details to any of the important persons that you added or a combination of the persons, useful in case of joint ownership, depending on who owns the asset or is responsible for the liability.

The real estate section allows you to enter various types of properties. You can use “Other” for those properties that cannot be categorized as per the dropdown options.

The section on loans and liabilities below allows you enter details regarding your home loan, credit card outstanding, auto loan, personal loan etc.

Unfortunately the insurance section has limited options and health insurance, auto insurance, and home insurance are not available as separate categories but will need to be clubbed under “other”.

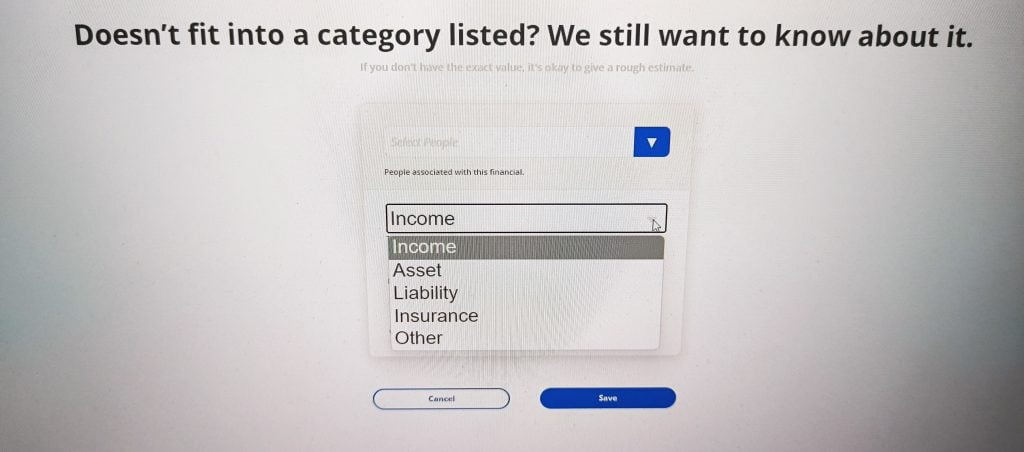

Lastly whichever of your financial details that do not fit an existing category can be provided in the last section shown below. You can use “Other” for living expenses, premiums etc. also.

The next section allows you to enter whatever else is on your mind that you would like to discuss with your investment advisor.

Anything else on your mind?

These could be objectives or financial goals that you feel are important to you and your family. Do not hold back. List down whatever is on your mind.

If there’s anything else you can use the next screen to communicate to your advisor.

Before finally submitting the Asset-Map questionnaire, recheck if you need to edit any of the details that you have entered, edit them and then submit your questionnaire.

Congrats!! Your questionnaire has been submitted. Sit back and relax. Your advisor will get in touch with you to arrange a discovery meeting.