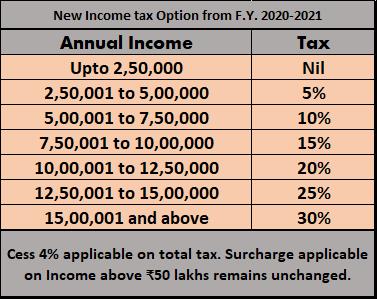

Finance bill 2020 provides two options while paying Income tax from F.Y. 2020-21 i.e. Assessment year 2021-22 onwards.

How does a resident individual choose an option? Should the individual choose the option at the start of the next financial year or wait till return filing time?

The new Income tax regime has been touted as a “simplified tax regime”

New income tax structure[/caption]

What are the benefits for a taxpayer in the new Income tax regime?

1. No need to make any knee-jerk last-minute investments to save tax.

Due to withdrawal of most exemptions, a salaried taxpayer need not take tips/advice on investing in ELSS, Endowment policies, ULIPs etc to save tax the next time he/she’s reminded by their HR department on their tax outgo.

2. No need to worry about salary restructuring while joining a new firm or after getting an annual

increment.

3. No need to worry about retaining and filing various receipts to claim exemptions/deductions.

Filing/storing Rent receipts, Tuition fee receipts, leave travel concession bills etc are a thing of

the past if you choose the new income tax option.

Tax paid by an individual earning ₹8.5L p.a.

4. No need to buy a house “to claim deduction of interest on housing loan”.

If you want to buy a house please consider factors like rental yield, liquidity, ability to service the housing loan rather than to save tax. This applies regardless of which option you choose.

5. Take time to list down your major financial goals and start saving and investing towards them since your net pay would be higher. The latter would apply if you don’t use most of the exemptions anyway.

Restructure your Salary one-time and remove allowances included to claim exemptions earlier.

You now have an option to save the extra in-hand salary to meet your financial goals.

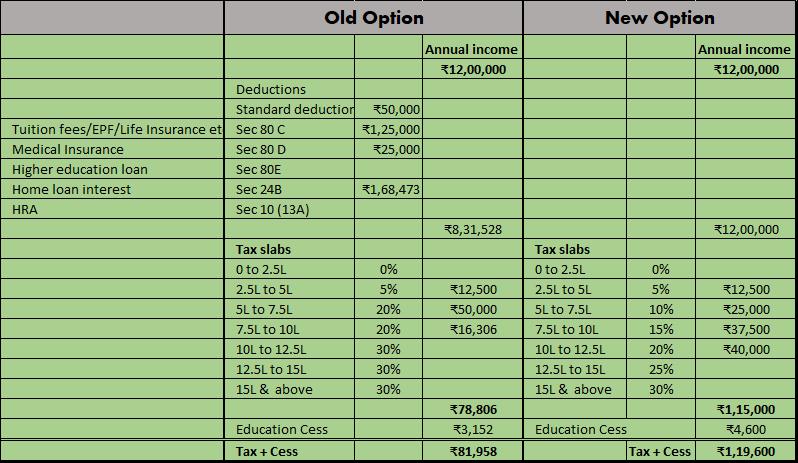

Tax paid by an individual earning ₹12L p.a.[/caption]

What are the exemptions that you must forego?

1. Section 80C

You cannot claim deductions (up to ₹1.5L p.a.) against:

- Fees paid for your children’s School/College tuition.

- Term Insurance premium paid to protect your family against your untimely demise.

- Repayment of housing loan principal.

- Your contribution to EPF/PPF.

- Your contribution to your daughter’s Sukanya Samriddhi Yojana account.

2. Section 80D

This section allows you to claim deductions up to ₹25,000 for Health insurance premium paid for Self/Family. Unfortunately, you cannot claim any deduction for Health insurance paid for your parents either. The latter depending on whether they are seniorcitizens can be a deduction of up to ₹50,000 in the old tax regime.

3. Section 80E

Any interest paid (for a maximum of 8 years) against a loan for Higher Education taken from an authorised financial institution is fully tax deductible in the old tax regime. The loan can be for Self, Spouse or children.

Tax paid by an individual earning ₹18L p.a.[/caption]

4. Section 24B

Any interest paid on your self-occupied property up to ₹2L per annum cannot be claimed as a deduction in the new tax regime.

5. Section 80EEA

Additional deduction against interest paid to a financial institution for acquiring residential property up to ₹1.5L p.a.

6. Section 10 (clause 5)

Leave travel concession – Claim Twice in a block of 4 years in the old tax regime.

7. Section 10 (clause 13A)

House rent allowance – The old tax regime allows a deduction on the

house rent allowance paid by your employer, if you’re living in a rented property and paying the rent.

8. Section 16(IA)

Forego Standard deduction up to ₹50,000 from Salary which is available in the old tax regime.

Tax paid by an individual earning ₹30L p.a.[/caption]

You can use this link to check how much tax you’ll save in the new regime.

Which option is right for you?

Only you can answer this question.

A lot of the exemptions in the old Income tax regime are for expenses like Children’s tuition fees, Term insurance/Health insurance premiums, House rent paid, Interest paid on Self-occupied property/Higher education loan etc. How many of these are applicable to you and to what extent?

Similarly, given a lack of pensions post-retirement in private firms, EPF/PPF contributions are critical in building a retirement corpus.

Do you have investments and savings other than mandatory ones like EPF? Are you stuck with tax-saving investments like ULIP’s/ELSS/Endowment policies etc? This would be a good time to take a re-look at your portfolio.

When should you choose the tax option?

Choose your option at the start of the financial year and communicate to your HR department accordingly. This can aid in your investments becoming a matter of habit rather than tax-time led.

Remember, both the options will be available every financial year for individuals who do not have any business income.