What is debt? How does it work? Why is it important for you to understand debt? Debt is money that is owed and needs to be repaid over time. It is taken on when an individual, business or entity borrows money. Debt can be a useful financial tool when used wisely, but can also create hardship if it becomes excessive or unmanageable.

What is Debt?

Debt arises when a lender agrees to give a borrower money with the expectation that the total amount borrowed, known as the principal, will be paid back over time. The borrower may also be required to pay interest on the principal as a fee for borrowing the money.

There are two main types of debt:

- 🏦 Secured Debt – The debt is tied to collateral owned by the borrower, like a house or car. If the borrower fails to repay, the lender can seize the collateral. Examples include home loans and car loans.

- 🏦 Unsecured Debt – There is no collateral tied to the debt. Examples include credit cards, student loans and medical debt. The lender assumes higher risk in this kind of debt and hence charges a higher rate of interest.

Debt can also be categorized as short-term debt, which is for a duration of less than a year, or long-term debt, which has a repayment period of one year or longer.

| Type of Loan | Short Description | Interest Rate Range |

|---|---|---|

| Home Loan | Loan for buying or constructing a house | 6.5% – 8.5% |

| Car Loan | Loan for buying a car | 7.5% – 9.5% |

| Personal Loan | Unsecured loan for personal expenses | 10% – 24% |

| Education Loan | Loan for covering education expenses | 7.5% – 15% |

| Business Loan | Loan for business expansion or needs | 11% – 16% |

| Credit Card Debt | Debt accumulated on credit card due to unpaid balance | 24% – 42% |

Some common sources of debt for individuals in India include:

- 💳 Credit Cards – Revolving unsecured debt that incurs high interest if not fully paid off each month.

- 🤝 Personal Loans – Unsecured loans from banks and other lenders, often used to consolidate high-interest debt.

- 🏠 Home Loans – Long-term secured debt taken to purchase a home, backed by the home as collateral.

- 🚗 Car Loans – Secured debt taken to purchase a car, with the car as collateral.

- 🎓 Education Loans – Unsecured loans for higher education costs, must be repaid after course completion.

💭 Why Do People Get Into Debt?

There are two main reasons individuals take on debt:

- Necessity – Borrowing for major expenses or emergencies:

- ❤️🩹 Paying for critical medical costs

- 🏡 Buying a home, car or another asset

- Overspending/Poor Money Management – Mismanaging finances leading to reliance on external credit:

- Using credit cards excessively

- Living beyond one’s means

- FOMO

- Lacking budgets or financial plans

Some level of debt may be unavoidable. However, having no debt at all is difficult in today’s world.

Understanding the difference between “good” and “bad” debt is key to smart borrowing.

Good Debt vs Bad Debt 🏦

Not all debts are created equal. There are two main types of debt: good debt and bad debt. Good debt is an investment that will grow in value or generate long-term income. For example, a home loan or an education loan can be considered good debt because while the former is an investment in a growing asset, the latter helps you upgrade your skills.

Conversely, bad debt refers to using money to buy items that rapidly depreciate and fail to generate income.

This includes credit card debt incurred for shopping or personal loans taken out for vacations.

The Dangers of Debt

While some debt may be productive, excessive debt can create a long-lasting burden with the following risks:

- High Interest Costs – Interest charges accumulate and increase the total repayment amount. For example, a ₹5 lakh personal loan at 12% interest over 5 years results in total repayment amount of ₹6.8 lakhs.

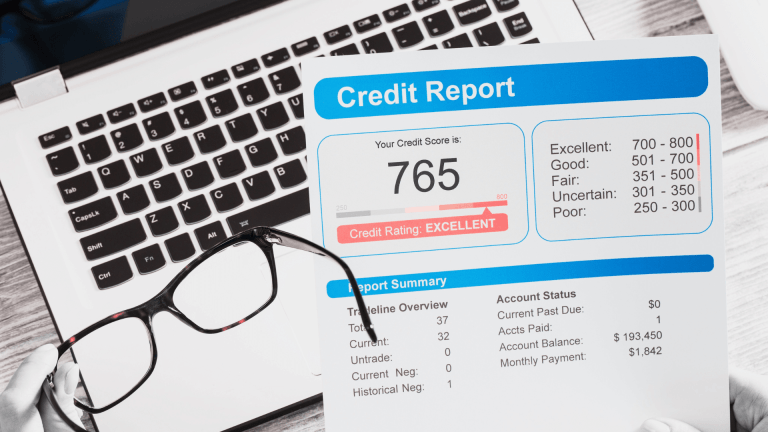

- Impacts Your Credit Score – Missed or late payments hurt your credit score. A lower score makes obtaining future loans more difficult and expensive.

- Causes Stress – Mounting debt obligations can create anxiety, depression and relationship issues. It takes a toll on both physical and mental health.

- Can Lead to Debt Traps – Borrowing more to repay existing debts can spiral out of control. Difficulty repaying small debts may lead to even bigger debts.

Actionable Tips: Strategies for Managing Debt 👍

Managing debt effectively requires a strategic approach. Here are some practical tips and strategies for managing your debt:

- Prioritize paying off high-interest debt i.e. unsecured personal loans first to reduce the total cost of your debt.

- Make more than the minimum payment when possible to pay off your debt faster.

- Consider debt consolidation or refinancing to lower your interest rates.

- Set up automatic payments to ensure you never miss a payment.

- Create a budget to track your income and expenses and to allocate funds for debt repayment.

- Maintain an emergency fund of minimum six months’ expenses.

Debt Quiz ❓

How much do you really know about debt? Take this quick quiz to find out!

- Which type of debt is tied to an asset used as collateral? a. Secured debt ✅ b. Unsecured debt

- Which usually has a lower interest rate – secured debt or unsecured debt? a. Secured debt ✅ b. Unsecured debt

- Is it possible to take on “good” debt that helps you achieve your goals? a. Yes, absolutely! ✅ b. No, all debt is bad

- Can excessive unmanaged debt impact mental health? a. Yes ✅ b. No

- Should you prioritize paying off high-interest debt first? a. Yes, the avalanche method ✅

b. No, pay off small debts first

How did you score? Understanding the basics puts you on the path towards mastering debt.

Conclusion: The Importance of Understanding Debt for Effective Financial Planning 🌟

Now that we’ve answered the what, how, and why of understanding debt, you’re well-equipped to navigate your financial journey. In the next article, we’ll look at effective strategies for managing this debt.