Term insurance transfers the risk of loss of income due to the death of an individual to the insurer, for the payment of an annual premium. If the insured dies during the policy period, the nominee gets a “death benefit” or “sum assured”.

One of the seven basics of personal finance is ensuring that, if needed, an individual has adequate insurance coverage.

Pure term insurance transfers this risk in a cost-effective manner, providing coverage during the policy period but not giving any “maturity pay-out” or “return-of-premium” if the insured individual survives the policy term.

Do you need term insurance?

Term insurance will be needed in these situations:

- An individual has an active source of income as a salaried employee, professional, self-employed, business owner etc., and

- The said individual has one or more person/s financially dependent on them.

Till what age is term insurance needed?

That’s a more difficult question to answer. An easier one would be to answer when it’s no longer required.

- The insured individual has enough savings & investments to take care of their current and future financial goals and expenses, their term insurance is no longer required.

- The individual has retired and subsequently does not earn an active income then the term insurance is no longer required either.

How can the required term insurance cover be calculated?

There are primarily two ways to go about doing this. One is to replace the income, till retirement, that would be lost due to the death of the insured family member and the second is to replace the current and future expenses of the household i.e. a needs-based approach.

Income replacement method

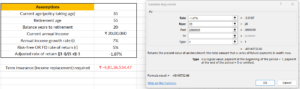

To calculate your term insurance requirement based on this method, you will need the following:

- Present value (PV) of your expected income cash-flows till retirement. This can be calculated using Excel using your current income/salary as a base and assuming the current annual income growth rate to continue till retirement. You will need to use the risk-free rate of return (Fixed deposit rate of return) as a discounting factor to calculate the adjusted rate of return.

Using the PV function in Excel, the required term insurance in the above hypothetical case, is ₹4.81crs.

The drawback of this method is that the following are not taken into consideration:

- Current and future living expenses of the family till the surviving spouse’s life expectancy.

- Corpus required for current and future financial goals like education, asset purchase, travel etc.

The income replacement method could lead to a high degree of under or over-insurance since only the individual’s income is taken into consideration.

Needs based method

In this method, the term insurance requirement takes into consideration the current and future needs of the family including corpus required for living expenses, financial goals, and debt management.

PV of monthly living expenses till the nominated family member’s life expectancy, corpus for financial goals like planning for children’s higher education, their marriage, purchase of a residential property, and clearing of any outstanding loans or debts form part of the required coverage while calculating needs-based term insurance.

However, present value of disposable financial and non-financial assets, death benefits from existing policies, and surviving spouse’s income stream till retirement would be reduced from the required term insurance amount to arrive at the net insurance requirement.

Disposable financial and non-financial assets assumes that the said assets will be passed on to the term insurance nominee through the means of a will. Else, only the rightful share of the nominee can be taken into consideration while calculating the insurance requirement.

Depending on the individual’s life stage, term insurance coverage requirement will vary in their future requiring regular review of the amount of coverage.

Hence, reviewing term insurance coverage every 3-4 years allows one to either add-on and buy additional coverage or reduce coverage by letting one or more of the term policies lapse.

Review term insurance coverage

- Have your goals for the next 5-10 years changed? You might have additional responsibilities like a bigger family, kids might have grown and are closer to higher education, early retirement could be on the agenda for yourself, etc.

- Your family’s income has increased allowing you to invest a bigger surplus towards your goals.

- You are nearer to paying off a large home loan, increasing your net worth or you might have taken a large loan recently reducing your net worth considerably.

To summarise, pure term insurance protects your family’s risk of loss of income. The best thing that can happen is you surviving the policy term and your family’s not needing to claim any of it.